"Times are tough: Only $140B for Wall St. banksters"

By Holly Sklar, Sunday, November 8, 2009 - www.bostonherald.com - Columnists

Taxpayer bailouts saved Wall Street from choking on its own greed. Now, as the Wall Street Journal reports, “Major U.S. banks and securities firms are on pace to pay their employees about $140 billion this year - a record high.”

Folks, $140 billion is more than the combined budgets of the U.S. departments of Commerce, Education, Energy, Housing and Urban Development, the National Science Foundation and the Environmental Protection Agency.

Typical workers, meanwhile, make less today adjusting for inflation than they did in the 1970s. Wall Street rewarded CEOs who cut employee wages and benefits and offshore manufacturing, services and research and development; turned mortgages into loan sharking; and sucked home equity, college funds, retirement funds and other private and public investments into their rigged casino.

Goldman Sachs, for example, “peddled billions of dollars in shaky securities tied to subprime mortgages on unsuspecting pension funds, insurance companies and other investors when it concluded that the housing bubble would burst,” McClatchy News Service reports in a new investigative series.

The Great Depression gave way to the New Deal. The Great Recession has become the Great Ripoff.

Believe it or not, oversight officials say “the firms that were ‘too big to fail’ are in many cases bigger still, many as a result of government-supported and sponsored mergers and acquisitions.”

Enabled by the Bush and Obama administrations, the megabanks are lending less and gambling more - using taxpayer money to pay bonuses, float a new stock market bubble and make even riskier bets. The Treasury and Federal Reserve have become Wall Street’s ATMs, while unemployment, foreclosures and homelessness rise, states slash services, average citizens are priced out of health care, and small businesses are starved of credit.

Trillions of dollars are flowing to the banksters in the form of near-zero interest loans, bond guarantees and extreme leverage for toxic assets. You can follow the money at nomiprins.com. (Nomi Prins, a former managing director at Goldman Sachs, is author of “It Takes a Pillage.”)

The megabanks are not too big to fail. They’re too big and irresponsible to exist. By 2002, the four major bank holding companies - Bank of America, JP Morgan Chase, Wells Fargo and Citigroup - had 27 percent of FDIC-insured bank assets. Now, reports the Economic Policy Institute, they have half. They overlap with derivatives dealers JP Morgan, Goldman Sachs, Bank of America, Morgan Stanley and Citigroup.

The government heavily subsidizes the megabanks, but it’s the small banks that provide higher savings interest, lower fees, lower loan and credit card rates, and do much of the lending to small business, who create most new jobs.

Behind their Main Street rhetoric, Congress and the Obama administration have been the nonchange Wall Street can believe in.

Make your voices heard. We need to enact tough regulations and bust the banks who busted our economy before they do it again.

My other Blogs are: luciforo.blogspot.com & frankguinta.blogspot.com & aldermanpetersullivan.blogspot.com & I have also posted many comments on berkshireeagle.blogspot.com & I have also posted many comments on planetvalenti.com

Jonathan Melle

I turned 39 (2014)

Sunday, November 8, 2009

Subscribe to:

Comments (Atom)

About Me

- Jonathan Melle

- Amherst, NH, United States

- I am a citizen defending the people against corrupt Pols who only serve their Corporate Elite masters, not the people! / My 2 political enemies are Andrea F. Nuciforo, Jr., nicknamed "Luciforo" and former Berkshire County Sheriff Carmen C. Massimiano, Jr. / I have also pasted many of my political essays on "The Berkshire Blog": berkshireeagle.blogspot.com / I AM THE ANTI-FRANK GUINTA! / Please contact me at jonathan_a_melle@yahoo.com

50th Anniversary - 2009

The Naismith Memorial Basketball Hall of Fame on Columbus Avenue in Springfield, Massachusetts.

Pittsfield Politics: Capitanio, Mazzeo agree on budget cuts, public safety

Paul Capitanio, left, speaks during Monday night's Ward 3 City Council debate with fellow candidate Melissa Mazzeo at Pittsfield Community Television's studio. The special election (3/31/2009) will be held a week from today (3/24/2009). The local issues ranged from economic development and cleaning up blighted areas in Ward 3 to public education and the continued remediation of PCB's.

Red Sox v Yankees

Go Red Sox!

Outrage swells in Congress!

Senate Banking Committee Chairman Sen. Christopher Dodd, D-Conn., left, and the committee's ranking Republican Sen. Richard Shelby, R-Ala., listen during a hearing on modernizing insurance regulations, Tuesday, March 17, 2009, on Capitol Hill in Washington. (AP Photo/Susan Walsh). - http://news.yahoo.com/s/politico/20090318/pl_politico/30833

Beacon Hill's $pecial Interest Tax Raisers & $PENDERS!

Photo Gallery: www.boston.com/news/local/massachusetts/articles/2009/03/15/St_Patricks_Day_Boston/

The path away from Wall Street ...

...Employers in the finance sector - traditionally a prime landing spot for college seniors, particularly in the Northeast - expect to have 71 percent fewer jobs to offer this year's (2009) graduates.

Economic collapse puts graduates on unforeseen paths: Enrollment in public service jobs rising...

www.boston.com/news/local/massachusetts/articles/2009/03/14/economic_collapse_puts_graduates_on_unforeseen_paths/

Bank of America CEO Ken Lewis

Should he be fired? As Bank of America's Stock Plummets, CEO Resists Some Calls That He Step Down.

Hookers for Jesus

Annie Lobert is the founder of "Hookers for Jesus" - www.hookersforjesus.net/home.cfm - Saving Sin City: Las Vegas, Nevada?

Forever personalized stamped envelope

The Forever stamp will continue to cover the price of a first-class letter. The USPS will also introduce Forever personalized, stamped envelopes. The envelopes will be preprinted with a Forever stamp, the sender's name and return address, and an optional personal message.

Purple Heart

First issued in 2003, the Purple heart stamp will continue to honor the men and women wounded while serving in the US military. The Purple Heart stamp covers the cost of 44 cents for first-class, one-ounce mail.

Dolphin

The bottlenose is just one of the new animals set to appear on the price-change stamps. It will serve as a 64-cent stamp for odd shaped envelopes.

2009 price-change stamps

www.boston.com/business/gallery/2009pircechangestamps/ -&- www.boston.com/news/nation/washington/articles/2009/02/27/new_stamps_set_for_rate_increase_in_may/

Red Sox v Yankees

Go Red Sox!

President Barack Obama

AP photo v Shepard Fairey

Rush Limbaugh lackeys

Posted by Dan Wasserman of the Boston Globe on March 3, 2009.

Honest Abe

A 2007 US Penny

Dog race

Sledding for dogs

The Capital of the Constitution State

Hartford, once the wealthiest city in the United States but now the poorest in Connecticut, is facing an uphill battle.

Brady, Bundchen married

Patriots quarterback Tom Brady and model Gisele Bundchen wed Feb. 26, 2009 in a Catholic ceremony in Los Angeles. www.boston.com/ae/celebrity/gallery/tom_gisele/

Mayor Jimmy Ruberto

Tanked Pittsfield's local economy while helping his fellow insider political hacks and business campaign contributors!

Journalist Andrew Manuse

www.manuse.com

New Hampshire Supreme Court Building

http://en.wikipedia.org/wiki/New_Hampshire_Supreme_Court

Economic State of the Union

A look at some of the economic conditions the Obama administration faces and what resources have already been pledged to help. 2/24/2009

President Barack Obama

The president addresses the nation's governors during a dinner in the State Dinning Room, Sunday, Feb. 22, 2009, at the White House in Washington. (AP Photo/Haraz N. Ghanbari).

The Oscars - 2/22/2009.

Hugh Jackman and Beyoncé Knowles teamed up for a musical medley during the show.

The 81st Academy Awards - Oscars - 2009

Hugh Jackman pulled actress Anne Hathaway on stage to accompany him during his opening musical number.

Rachel Maddow

A Progressive News Commentator

$500,000 per year

That is chump change for the corporate elite!

THE CORPORATE ELITE...

Jeffrey R. Immelt, chairman and chief executive of General Electric

The Presidents' Club

Bush, Obama, Bush Jr, Clinton & Carter.

5 Presidents: Bush, Obama, Bush Jr, Clinton, & Carter!

White House Event: January 7, 2009.

Bank Bailout!

v taxpayer

Actress Elizabeth Banks

She will present an award to her hometown (Pittsfield) at the Massachusetts State House next month (1/2009). She recently starred in "W" and "Zack and Miri Make a Porno," and just signed a $1 million annual contract to be a spokesmodel for

Joanna Lipper

Her award-winning 1999 documentary, "Growing Up Fast," about teenaged mothers in Pittsfield, Massachusetts.

Happy Holidays...

...from "Star Wars"

Massachusetts "poor" economy

Massachusetts is one of the wealthiest states, but it is also very inequitable. For example, it boasts the nation's most lucrative lottery, which is just a system of regressive taxation so that the corporate elite get to pay less in taxes!

Reese Witherspoon

Hollywood Actress

Peter G. Arlos.

Arlos is shown in his Pittsfield office in early 2000.

Turnpike OK's hefty toll hikes

Big Dig - East-west commuters take hit; Fees at tunnels would double. 11/15/2008.

The Pink Panther 2

Starring Steve Martin

Police ABUSE

I was a victim of Manchester Police Officer John Cunningham's ILLEGAL USES of FORCE! John Cunningham was reprimanded by the Chief of Police for disrespecting me. John Cunningham yelled at a witness: "I don't care if he (Jonathan Melle) is disabled!"

Barack Obama

The 44th US President!

Vote

Elections

The Bailout & the economic stimulus check

A political cartoon by Dan Wasserman

A rainbow over Boston

"Rainbows galore" 10/2/2008

Our nation's leaders!

President Bush with both John McCain & Barack Obama - 9/25/2008.

Massachusetts & Big Dig: Big hike in tolls for Pike looming (9/26/2008).

$5 rise at tunnels is one possibility $1 jump posed for elsewhere.

Mary E Carey

My FAVORITE Journalist EVER!

9/11/2008 - A Show of Unity!

John McCain and Barack Obama appeared together at ground zero in New York City - September 11, 2008.

John McCain...

...has all but abandoned the positions on taxes, torture and immigration. (A cartoon by Dan Wasserman. September 2008).

Dan Wasserman

The deregulated chickens come home to roost... in all our pocketbooks. September 2008.

Sarah Palin's phobia

A scripted candidate! (A cartoon by Dan Wasserman).

Dan Wasserman

Family FInances - September, 2008.

Mark E. Roy

Ward 1 Alderman for Manchester, NH (2008).

Theodore “Ted” L. Gatsas

Ward 2 Alderman (& NH State Senator) for Manchester, NH (2008).

Peter M. Sullivan

Ward 3 (downtown) Alderman for Manchester, NH (2008).

Jim Roy

Ward 4 Alderman for Manchester, NH (2008).

Ed Osborne

Ward 5 Alderman for Manchester, NH (2008).

Real R. Pinard

Ward 6 Alderman for Manchester, NH (2008).

William P. Shea

Ward 7 Alderman for Manchester, NH (2008).

Betsi DeVries

Ward 8 Alder-woman (& NH State Senator) for Manchester, NH (2008).

Michael Garrity

Ward 9 Alderman for Manchester, NH (2008).

George Smith

Ward 10 Alderman for Manchester, NH (2008).

Russ Ouellette

Ward 11 Alderman for Manchester, NH (2008).

Kelleigh (Domaingue) Murphy

Ward 12 Alder-woman for Manchester, NH (2008).

“Mike” Lopez

At-Large Alderman for Manchester, NH. (2008).

Daniel P. O’Neil

At-Large Alderman for Manchester, NH (2008).

Sarah Palin for Vice President.

Republican John McCain made the surprise pick of Alaska's governor Sarah Palin as his running mate today, August 29, 2008.

U.S. Representative John Olver, D-Amherst, Massachusetts.

Congressman Olver said the country has spent well over a half-trillion dollars on the war in Iraq while the situation in Afghanistan continues to deteriorate. 8/25/08.

Ed O'Reilly for US Senate in Massachusetts!

John Kerry's 9/2008 challenger in the Democratic Primary.

Shays' Rebellion

In a tax revolt, Massachusetts farmers fought back during Shays' Rebellion in the mid-1780s after The American Revolutionary War.

Julianne Moore

Actress. "The Big Lebowski" is one of my favorite movies. I also like "The Fugitive", too.

Rinaldo Del Gallo III & "Superman"

Go to: http://www.berkshirefatherhood.com/index.php?mact=News,cntnt01,detail,0&cntnt01articleid=699&cntnt01returnid=69

"Income chasm widening in the Commonwealth of Massachusetts"

The gap between rich and poor has widened substantially in Massachusetts over the past two decades. (8/15/2008).

Dan "Bureaucrat" Bosley

"The Bosley Amendment": To create tax loopholes for the wealthiest corporate interests in Massachusetts!

John Edwards and...

...Rielle Hunter. WHO CARES?!

Rep. Edward J. Markey

He wants online-privacy legislation. Some Web Firms Say They Track Behavior Without Explicit Consent.

Cindy Sheehan

She gained fame with her antiwar vigil outside the Bush ranch.

Olympics kick off in Beijing

Go USA!

Exxon Mobil 2Q profit sets US record, shares fall

In this May 1, 2008, file photo, a customer pumps gas at an Exxon station in Middleton, Mass. Exxon Mobil Corp. reported second-quarter earnings of $11.68 billion Thursday, July 31, the biggest quarterly profit ever by any U.S. corporation, but the results were well short of Wall Street expectations and its shares fell as markets opened. (AP Photo/Lisa Poole, File) 7/31/2008.

Onota Lake 'Sea Serpent'

Some kind of monster on Onota Lake. Five-year-old Tyler Smith rides a 'sea serpent' on Onota Lake in Pittsfield, Mass. The 'monster,' fashioned by Smith's grandfather, first appeared over July 4 weekend. (Photo courtesy of Ron Smith). 7/30/2008.

Al Gore, Jr.

Al Gore issues challenge on energy

The Norman Rockwell Museum

Stockbridge, Massachusetts

"Big Dig"

Boston's financially wasteful pork barrel project!

"Big Dig"

Boston's pork barrel public works project cost 50 times more than the original price!

Mary E Carey

My favorite journalist EVER!

U.S. Rep. John Olver, state Sen. Stan Rosenberg and Selectwomen Stephanie O'Keeffe and Alisa Brewer

Note: Photo from Mary E Carey's Blog.

Tanglewood

Boston Symphony Orchestra music director James Levine.

Chagall

Jimmy Ruberto

Faces multiple persecutions under the Massachusetts "Ethics" conflict of interest laws.

Barack Obama

Obama vows $500m in faith-based aid.

John McCain

He is with his wife, Cindy, who were both met by Colombian President Alvaro Uribe (right) upon arriving in Cartagena.

Daniel Duquette

Sold Mayor James M. Ruberto of Pittsfield two tickets to the 2004 World Series at face value.

Hillary & Barack in Unity, NH - 6/27/2008

Clinton tells Obama, crowd in Unity, N.H.: 'We are one party'

John Forbes Kerry

Wanna-be Prez?

WALL-E

"out of this World"

Crisis in the Congo - Ben Affleck

http://abcnews.go.com/Nightline/popup?id=5057139&contentIndex=1&page=1&start=false - http://abcnews.go.com/Nightline/story?id=5234555&page=1

Jeanne Shaheen

NH's Democratic returning candidate for U.S. Senate

"Wall-E"

a cool robot

Ed O'Reilly

www.edoreilly.com

Go Celtics!

World Champions - 2008

Go Red Sox!

J.D. Drew gets the same welcome whenever he visits the City of Brotherly Love: "Booooooo!"; Drew has been vilified in Philadelphia since refusing to sign with the Phillies after they drafted him in 1997...

Joe Kelly Levasseur & Joe Briggs

www.2joes.org

NH Union Leader

Editorial Cartoon

Celtics - World Champions!

www.boston.com/sports/basketball/celtics/gallery/06_18_08_front_pages/ - www.boston.com/sports/basketball/celtics/gallery/06_17_08_finals_game_6/ - www.boston.com/sports/basketball/celtics/gallery/06_17_08_celebration/ - www.boston.com/sports/basketball/celtics/gallery/06_15_08_celtics_championships/

"The Nation"

A "Liberal" weekly political news magazine. Katrina vanden Heuvel.

TV - PBS: NOW

http://www.pbs.org/now

The Twilight Zone

List of Twilight Zone episodes - http://en.wikipedia.org/wiki/List_of_Twilight_Zone_episodes

Equality for ALL Marriages

I, Jonathan Melle, am a supporter of same sex marriages.

Kobe Bryant leads his time to a Game 5 victory.

L.A. Lakers holds on for the win to force Game 6 at Boston

Mohawk Trail

The 'Hail to the Sunrise' statue in Charlemont is a well-known and easily recognized landmark on the Mohawk Trail. The trail once boasted several souvenir shops, some with motels and restaurants. Now only four remain. (Caroline Bonnivier / Berkshire Eagle Staff).

NASA - June 14, 2008

Space Shuttle Discovery returns to Earth.

Go Celtics! Game # 4 of the 2008 NBA Finals.

Boston took a 20-second timeout, and the Celtics ran off four more points (including this incredible Erving-esque layup from Ray Allen) to build the lead to five points with just 2:10 remaining. Reeling, the Lakers took a full timeout to try to regain their momentum.

Sal DiMasi

Speaker of the Massachusetts State House of Representatives

Kelly Ayotte - Attorney General of New Hampshire

http://doj.nh.gov/

John Kerry

He does not like grassroots democracy & being challenged in the 2008 Massachusetts Democratic Party Primary for re-election.

Tim Murray

Corrupt Lt. Gov. of Massachusetts, 2007 - 2013.

North Adams, Massachusetts

downtown

Howie Carr

Political Satirist on Massachusetts Corruption/Politics

Polar Bear

Global Warming

Elizabeth Warren - Web-Site Links

http://en.wikipedia.org/wiki/Elizabeth_Warren & http://www.creditslips.org/creditslips/WarrenAuthor.html

Elizabeth Warren

Consumer Crusader

Leon Powe

Celtics forward Leon Powe finished a fast break with a dunk.

Kevin Garnett

Kevin Garnett reacted during the game.

Rajon Rondo

Rajon Rondo finished a first half fast break with a dunk.

Teamwork

Los Angeles Lakers teammates help Pau Gasol (16) from the floor in the second quarter.

Kobe Bryant

Kobe Bryant took a shot in the first half of Game 2.

Kendrick Perkins

Kendrick Perkins (right) backed down Lamar Odom (left) during first half action.

Go Celtics!

The Boston Symphony Orchestra performed the national anthem prior to Game 2.

K.G.!

Garnett reacted to a hard dunk in the first quarter.

Paul Pierce

Paul Pierce reacted after hitting a three upon his return to the game since leaving with an injury.

Go Celtics!

Kobe Bryant (left) and Paul Pierce (right) squared off in the second half of the game.

James Taylor

Sings National Anthem at Celtics Game.

John Forbes Kerry & Deval Patrick

Attended Celtics Game.

Greats of the NBA: Dr. J, Bill Russell, & Kareem!

Attend Game 1 of the 2008 NBA Finals.

Bruce Willis

The actor (left) and his date were in the crowd before the Celtics game.

John Kerry

Golddigger attends Celtics game

Hillary Clinton

Ends her 2008 bid for Democratic Party nomination

Nonnie Burnes

Massachusetts Insurance Commish & former Judge

Jones Library

Amherst, Massachusetts

Barack Obama & Hillary Clinton

2008 Democratic Primary

"US vs Exxon and Halliburton"

.png)

U.S. Senator John Sununu took more than $220,000 from big oil.

Jeanne Shaheen

4- U.S. Senate - 2008

William Pignatelli

Hack Rep. "Smitty" with Lynne Blake

Ben Bernanke

Federal Reserve Chairman

Gazettenet.com

www.gazettenet.com/beta/

Boys' & Girls' Club

Melville Street, Pittsfield, Massachusetts

Denis Guyer

Dalton State Representative

The Berkshire Eagle

Pittsfield, Massachusetts

Carmen Massimiano

Williams College - May 2008

Larry Bird & Magic Johnson

www.boston.com/lifestyle/gallery/when_the_celtics_were_cool/

Regressive Taxation! via State Lotteries

New Massachusetts state lottery game hits $600 million in sales!

Andrea Nuciforo

"Luciforo"

John Barrett III

Long-time Mayor of North Adams Massachusetts

Shine On

Elmo

cool!

Paul Pierce

Paul Pierce kissed the Eastern Conference trophy. 5/30/2008. AP Photo.

Kevin Garnett & Richard Hamilton

Kevin Garnett (left) talked to Pistons guard Richard Hamilton (right) after the Celtics' victory in Game 6. 5/30/2008. Reuters Photo.

Paul Pierce

Paul Pierce showed his team colors as the Celtics closed out the Pistons in Game 6 of the Eastern Conference finals. 5/30/2008. Globe Staff Photo / Jim Davis.

Joseph Kelly Levasseur

One of my favorite politicians!

Mary E Carey

In the Big Apple: NYC! She is the coolest!

Guyer & Kerry

My 2nd least favorite picture EVER!

Mary Carey

My favorite journalist EVER!

Nuciforo & Ruberto

My least favorite picture EVER!

Jeanne Shaheen

U.S. Senate - 2008

NH Fisher Cats

AA Baseball - Toronto Blue Jays affiliate

Manchester, NH

Police Patch

Michael Briggs

#83 - We will never forget

Michael "Stix" Addison

http://unionleader.com/channel.aspx/News?channel=2af17ff4-f73b-4c44-9f51-092e828e1131

Charlie Gibson

ABC News anchor

Scott McClellan

http://topics.nytimes.com/top/reference/timestopics/people/m/scott_mcclellan/index.html?inline=nyt-per

Boise, Idaho

Downtown Boise Idaho

John Forbes Kerry

Legislative Hearing in Pittsfield, Massachusetts, BCC, on Wednesday, May 28, 2008

Thomas Jefferson

My favorite classical U.S. President!

NH Governor John Lynch

Higher Taxes, Higher Tolls

Paul Hodes

My favorite Congressman!

Portland Sea Dogs

AA Red Sox

New York

Magnet

Massachusetts

Magnet

New Hampshire

Magnet

New Hampshire

Button

Carmen Massimiano

"Luciforo" tried to send me to Carmen's Jail during the Spring & Summer of 1998.

Kay Khan - Massachusetts State Representative

www.openmass.org/members/show/174

Luciforo

Andrea F Nuciforo II

B-Eagle

Pittsfield's monopoly/only daily newspaper

Jon Lester - Go Red Sox!

A Red Sox No Hitter on 5/19/2008!

Go Red Sox!

Dustin Pedroia & Manny Ramirez

U.S. Flag

God Bless America!

Jonathan Melle's Blog

Hello, Everyone!

Molly Bish

We will never forget!

Go Celtics!

Celtics guard Rajon Rondo listens to some advice from Celtics head coach Doc Rivers in the first half.

Go Celtics!

Celtics forward Kevin Garnett and Pistons forward Rasheed Wallace embrace at the end of the game.

Go Red Sox!

Red Sox closer Jonathan Papelbon calls for the ball as he charges toward first base. Papelbon made the out en route to picking up his 14th save of the season.

Go Red Sox!

Red Sox starting pitcher Daisuke Matsuzaka throws to Royals David DeJesus during the first inning.

Go Red Sox!

Red Sox pitcher Daisuke Matsuzaka delivers a pitch to Royals second baseman Mark Grudzielanek during the second inning.

Go Red Sox!

Red Sox right fielder J.D. Drew is welcomed to home plate by teammates Mike Lowell (left), Kevin Youkilis (2nd left) and Manny Ramirez after he hit a grand slam in the second inning.

Go Red Sox!

Red Sox third baseman Mike Lowell crosses the plate after hitting a grand slam during the sixth inning. Teammates Manny Ramirez and Jacoby Ellsbury scored on the play. The Red Sox went on to win 11-8 to complete a four-game sweep and perfect homestand.

JD Drew - Go Red Sox

www.boston.com/sports/baseball/redsox/gallery/05_22_08_sox_royals/

Thank you for serving; God Bless America!

Master Sgt. Kara B. Stackpole, of Westfield, holds her daughter, Samantha, upon her return today to Westover Air Reserve Base in Chicopee. She is one of the 38 members of the 439th Aeromedical Staging Squadron who returned after a 4-month deployment in Iraq. Photo by Dave Roback / The Republican.

Kathi-Anne Reinstein

www.openmass.org/members/show/175

Ted Kennedy

Tragic diagnosis: Get well Senator!

Google doodle - Jonathan Melle Internet search

http://blogsearch.google.com/blogsearch?hl=en&q=jonathan+melle+blogurl:http://jonathanmelleonpolitics.blogspot.com/&ie=UTF-8

John Forbes Kerry

Billionaire U.S. Senator gives address to MCLA graduates in North Adams, Massachusetts in mid-May 2008

Andrea Nuciforo

"Luciforo"

A Red Sox Fan in Paris, France

Go Red Sox!

Rinaldo Del Gallo III

Interviewed on local TV

Andrea Nuciforo

Luciforo!

John Adams

#2 U.S. President

Jonathan Melle

I stood under a tree on the afternoon of May 9, 2008, on the foregrounds of the NH State House - www.websitetoolbox.com/tool/post/nhinsider/vpost?id=2967773

Jonathan Melle

Inside the front lobby of the NH State House

Jonathan Melle

Bill Clinton campaign memorabilia

Jonathan Melle

Liberty Bell & NH State House

Jon Keller

Boston based political analyst

Jon Keller

Boston based political analyst

Jonathan Melle

Franklin Pierce Statue #14 U.S. President

Jonathan Melle

NH State House

Jonathan Melle

Stop the War NOW!

Jonathan Melle

"Mr. Melle, tear down this Blog!"

Jonathan Melle

I stood next to a JFK photo

Jonathan Levine, Publisher

The Pittsfield Gazette Online

Jonathan Melle

I made rabbit ears with John & George

Jonathan Melle

I made antenna ears with John & George

Jonathan Melle

I impersonated Howard Dean

Jonathan Melle

mock-voting

Jonathan Melle

pretty ladies -/- Go to: http://www.wgir.com/cc-common/cc_photopop20.html?eventID=28541&pagecontent=&pagenum=4 - Go to: http://current.com/items/88807921_veterans_should_come_first_not_last# - http://www.mcam23.com/cgi-bin/cutter.cgi?c_function=STREAM?c_feature=EDIT?dir_catagory=10MorningRadio?dir_folder=2JoesClips?dir_file=JonathanMelle-090308? -

Jonathan Melle

Go Red Sox! Me at Fenway Park

Mary E. Carey

My favorite journalist! Her voice sings for the Voiceless. -/- Go to: http://aboutamherst.blogspot.com/search?q=melle -/- Go to: http://ongeicocaveman.blogspot.com/search?q=melle

Velvet Jesus

Mary Carey blogs about my political writings. This is a picture of Jesus from her childhood home in Pittsfield, Massachusetts. -//- "How Can I Keep From Singing" : My life goes on in endless song / Above Earth's lamentations, / I hear the real, though far-off hymn / That hails a new creation. / / Through all the tumult and the strife / I hear its music ringing, / It sounds an echo in my soul. / How can I keep from singing? / / Whey tyrants tremble in their fear / And hear their death knell ringing, / When friends rejoice both far and near / How can I keep from singing? / / In prison cell and dungeon vile / Our thoughts to them are winging / When friends by shame are undefiled / How can I keep from singing?

www.truthdig.com

www.truthdig.com

Jonathan Melle

Concord NH

The Huffington Post

http://fundrace.huffingtonpost.com/neighbors.php?type=loc&newest=1&addr=&zip=01201&search=Search

Barack Obama

smiles & beer

Jonathan Lothrop

A Pittsfield City Councilor

Michael L. Ward

A Pittsfield City Councilor

Peter Marchetti - Pittsfield's City Councilor at Large

Pete always sides with the wealthy's political interests.

Gerald Lee - Pittsfield's City Council Prez

Gerald Lee told me that I am a Social Problem; Lee executes a top-down system of governance. R.I.P. Gerry Lee.

Matt Kerwood - Pittsfield's Councilor at Large

Kerwood poured coffee drinks for Jane Swift

Louis Costi

Pittsfield City Councilor

Lewis Markham

Pittsfield City Councilor

Kevin Sherman - Pittsfield City Councilor

Sherman ran for Southern Berkshire State Rep against Smitty Pignatelli; Sherman is a good guy.

Anthony Maffuccio

Pittsfield City Councilor

Linda Tyer

Pittsfield City Councilor

Daniel Bianchi

A Pittsfield City Councilor

The Democratic Donkey

Democratic Party Symbol

Paramount

What is Paramount to you?

NH's Congresswoman

Carol Shea-Porter, Democrat

Sam Adams Beer

Boston Lager

Ratatouille

Disney Animation

Ruberto Details Plans for Success - January 07, 2008

"Luciforo" swears in Mayor Ruberto. Pittsfield Politics at its very worst: 2 INSIDER POWERBROKERS! Where is Carmen Massimiano? He must be off to the side.

Abe

Lincoln

Optimus Prime

Leader of the Autobots

Optimus Prime

1984 Autobot Transformer Leader

Cleanup Agreements - GE & Pittsfield's PCBs toxic waste sites

www.epa.gov/region1/ge/cleanupagreement.html

GE/Housatonic River Site: Introduction

www.epa.gov/region1/ge/

GE/Housatonic River Site - Reports

www.epa.gov/region1/ge/thesite/opca-reports.html

US EPA - Contact - Pittsfield's PCBs toxic waste sites

www.epa.gov/region1/ge/contactinfo.html

GE Corporate Logo - Pittsfield's PCBs toxic waste sites

www.epa.gov/region1/ge/index.html

Commonwealth Connector

Commonwealth Care

Blue Cross Blue Shield of Massachusetts

Healthcare Reform

Blue Cross Blue Shield of Massachusetts

Healthcare Reform

Network Health Forward - A Commonwealth Care Plan

Massachusetts Health Reform

Network Health Together: A MassHealth Plan - Commonwealth Care

Massachusetts Health Reform

www.network-health.org

Massachusetts Health Reform

Neighborhood Health Plan - Commonwealth Care

Massachusetts Health Reform

Fallon Community Health Plan - Commonwealth Care

Massachusetts Health Reform

BMC HealthNet Plan

Massachusetts Health Reform

Massachusetts Health Reform

Eligibility Chart: 2007

Harvard Pilgrim Healthcare

Massachusetts Health Reform

Business Peaks

Voodoo Economics

Laffer Curve - Corporate Elite

Reagonomics: Supply Side

Corporate Elite Propaganda

Mock Liberal Democratic Socialism Thinking

Real Estate Blues

www.boston.com/bostonglobe/magazine/2008/0316/

PEACE

End ALL Wars!

Freedom of Speech

Norman Rockwell's World War II artwork depicting America's values

Abraham Lincoln

A young Abe Lincoln

RACHEL KAPRIELIAN

www.openmass.org/members/show/218 - www.rachelkaprielian.com

Jennifer M. Callahan - Massachusetts State Representative

www.openmass.org/members/show/164 - www.boston.com/news/local/articles/2008/05/04/legislator_describes_threat_as_unnerving/

Human Rights for ALL Peoples!

My #1 Political Belief!

Anne Frank

Amsterdam, Netherlands, Europe

A young woman Hillary supporter

This excellent picture captures a youth's excitement

Hillary Clinton with Natalie Portman

My favorite Actress!

Alan Chartock

WAMC public radio in Albany, NY; Political columnist who writes about Berkshire County area politics; Strong supporter for Human Rights for ALL Peoples

OpenCongress.Org

This web-site uses some of my Blog postings

OpenMass.org

This web-site uses some of my blog postings!

Shannon O'Brien

One of my favorite politicians! She stands for the People first!

The Massachusetts State House

"The Almighty Golden Dome" - www.masslegislature.tv -

Sara Hathaway

Former Mayor of Pittsfield, Massachusetts

Andrea F. Nuciforo, Jr.

A corrupt Pol who tried to put me in Jail

Andrea F. Nuciforo, Jr.

Another view of Pittsfield's inbred, multigenerational political prince. Luciforo!

Luciforo

Nuciforo's nickname

"Andy" Nuciforo

Luciforo!

Carmen C. Massimiano, Jr., Berkshire County Sheriff (Jailer)

Nuciforo's henchman! Nuciforo tried to send me to Carmen's Jail

Andrea Nuciforo Jr

Shhh! Luciforo's other job is working as a private attorney defending wealthy Boston-area corporate insurance companies

Berkshire County Sheriff (Jailer) Carmen C. Massimiano, Jr.

Nuciforo tried to send me to Carmen's Jail! Carmen sits with the Congressman, John Olver

Congressman John Olver

Nuciforo's envy

The Dome of the U.S. Capitol

Our Beacon of American Democracy

Nuciforo's architect

Mary O'Brien in red with scarf

Sara Hathaway (www.brynmawr.edu)

Former-Mayor of Pittsfield, Massachusetts; Nuciforo intimidated her, along with another woman, from running in a democratic state election in the Spring of 2006!

Andrea F. Nuciforo II

Pittsfield Politics Pot $

Berkshire County Republican Association

Go to: www.fcgop.blogspot.com

Denis Guyer

Dalton State Representative

John Forbes Kerry & Denis Guyer

U.S. Senator & State Representative

John Kerry

Endorses Barack Obama for Prez then visits Berkshire County

Dan Bosley

A Bureaucrat impostoring as a Legislator!

Ben Downing

Berkshire State Senator

Christopher N Speranzo

Pittsfield's ANOINTED State Representative

Peter J. Larkin

Corrupt Lobbyist

GE - Peter Larkin's best friend!

GE's FRAUDULENT Consent Decree with Pittsfield, Massachusetts, will end up KILLING many innocent school children & other local residents!

GE's CEO Jack Welch

The Corporate System's Corporate Elite's King

Economics: Where Supply meets Demand

Equilibrium

GE & Pittsfield, Massachusetts

In 2007, GE sold its Plastics Division to a Saudi company. Now all that is left over by GE are its toxic PCB pollutants that cause cancer in many Pittsfield residents.

Mayor James M Ruberto

A small-time pol chooses to serve the corporate elite & other elites over the people.

Governor Deval Patrick

Deval shakes hands with Mayors in Berkshire County

Deval Patrick

Governor of Massachusetts

Pittsfield High School

Pittsfield, Massachusetts

Sara Hathaway

Pittsfield's former Mayor

Rinaldo Del Gallo III

Pittsfield Attorney focusing on Father's Rights Probate Court Legal Issues, & Local Politician and Political Observer

Rinaldo Del Gallo III

Very Intelligent Political Activists in Pittsfield, Massachusetts. Rinaldo Del Gallo, III, Esq. is the spokesperson of the Berkshire Fatherhood Coalition. He has been practicing family law and has been a member of the Massachusetts bar since 1996.

Mayor Ed Reilly

He supports Mayor Ruberto & works as a municipal Attorney. As Mayor, he backed Bill Weld for Governor in 1994, despite being a Democrat. He was joined by Carmen Massimiano & John Barrett III, the long-standing Mayor of North Adams.

Manchester, NH Mayor Frank Guinta

Cuts Dental Care for Public School Children-in-Need

Manchester, NH City Hall

My new hometown - view from Hanover St. intersection with Elm St.

Manchester NH City Democrats

Go Dems!

2008 Democratic Candidates for U.S. Prez

Barack Obama, Hillary Clinton, Mike Gravel, Dennis Kucinich, John Edwards

NH State House Dome

Concord, NH

Donna Walto

Pittsfield Politician -- She strongly opposes Mayor Jim Ruberto's elitist tenure.

Elmo

Who doesn't LOVE Elmo?

Hillary Clinton for U.S. President!

Hillary is for Children. She is my choice in 2008.

The White House in 1800

Home of our Presidents of the United States

John Adams

2nd President of the USA

Hillary Clinton stands with John Edwards and Joe Biden

Hillary is my choice for U.S. President!

Bill Clinton

Former President Bill Clinton speaks at the Radisson in Manchester NH 11/16/2007

Barack Obama

U.S. Senator & Candidate for President

Pittsfield's 3 Women City Councillors - 2004

Linda Tyer, Pam Malumphy, Tricia Farley-Bouvier

Wahconah Park in Pittsfield, Massachusetts

My friend Brian Merzbach reviews baseball parks around the nation.

The Corporate Elite: Rational Incentives for only the wealthy

The Elites double their $ every 6 to 8 years, while the "have-nots" double their $ every generation (or 24 years). Good bye Middle Class!

George Will

The human satellite voice for the Corporate Elite

Elizabeth Warren

The Anti-George Will; Harvard Law School Professor; The Corporate Elite's Worst Nightmare

The Flag of The Commonwealth of Massachusetts

I was born and raised in Pittsfield, Massachusetts

State Senator Stan Rosenberg

Democratic State Senator from Amherst, Massachusetts -/- Anti-Stan Rosenberg Blog: rosenbergwatch.blogspot.com

Ellen Story

Amherst Massachusetts' State Representative

Teen Pregnancy in Pittsfield, Mass.

Books are being written on Pittsfield's high teen pregancy rates! What some intellectuals do NOT understand about the issue is that TEEN PREGNANCIES in Pittsfield double the statewide average by design - Perverse Incentives!

NH Governor John Lynch

Supports $30 Scratch Tickets and other forms of regressive taxation. Another Pol that only serves his Corporate Elite Masters instead of the People!

U.S. Congresswoman Carol Shea Porter

The first woman whom the People of New Hampshire have voted in to serve in U.S. Congress

U.S. Congressman Paul Hodes

A good man who wants to bring progressive changes to Capitol Hill!

Paul Hodes for U.S. Congress

New Hampshire's finest!

Darth Vader

Star Wars

Dick Cheney & George W. Bush

The Gruesome Two-some! Stop the Neo-Cons' fascism! End the Iraq War NOW!

WAROPOLY

The Inequity of Globalism

Bushopoly!

The Corporate Elite have redesigned "The System" to enrich themselves at the expense of the people, masses, have-nots, poor & middle-class families

George W. Bush with Karl Rove

Rove was a political strategist with extraordinary influence within the Bush II White House

2008's Republican Prez-field

John McCain, Alan Keyes, Rudy Guiliani, Duncan Hunter, Mike Huckabee, WILLARD Mitt Romney, Fred Thompson, Ron Paul

Fall in New England

Autumn is my favorite season

Picturing America

picturingamerica.neh.gov

Winter Weather Map

3:45PM EST 3-Dec-07

Norman Rockwell Painting

Thanksgiving

Norman Rockwell Painting

Depiction of American Values in mid-20th Century America

Larry Bird #33

My favorite basketball player of my childhood

Boston Celtics Basketball - 2007-2008

Kevin Garnett hugs James Posey

Paul Pierce

All heart! Awesome basketball star for The Boston Celtics.

Tom Brady

Go Patriots!

Rupert Murdoch

Owner of Fox News - CORPORATE ELITE!

George Stephanopolous

A Corporate Elite Political News Analyst

Robert Redford

Starred in the movie "Lions for Lambs"

Meryl Streep

Plays a jaded journalist with integrity in the movie "Lions for Lambs"

Tom Cruise

Tom Cruise plays the Neo-Con D.C. Pol purely indoctrinated by the Corporate Elite's political agenda in the Middle East

CHARLIZE THERON

"I want to say I've never been surrounded by so many fake breasts, but I went to the Academy Awards."

Amherst Town Library

Amherst, NH - www.amherstlibrary.org

Manchester NH Library

I use the library's automated timed 1-hour-per-day Internet computers to post on my Blog - www.manchester.lib.nh.us

Manchester NH's Palace Theater

Manchester NH decided to restore its Palace Theater

Pittsfield's Palace Theater

Pittsfield tore down this landmark on North Street in favor of a parking lot

Pleasant Street Theater

Amherst, Massachusetts

William "Shitty" Pignatelli

A top down & banal State House Pol from Lenox Massachusetts -- A GOOD MAN!

The CIA & Mind Control

Did the CIA murder people by proxy assassins?

Skull & Bones

Yale's Elite

ImpeachBush.org

I believe President Bush should be IMPEACHED because he is waging an illegal and immoral war against Iraq!

Bob Feuer drumming for U.S. Congress v John Olver in 2008

www.blog.bobfeuer.us

Abe Lincoln

The 16th President of the USA

Power

Peace

Global Warming Mock Giant Thermometer

A member of Green Peace activist sets up a giant thermometer as a symbol of global warming during their campaign in Nusa Dua, Bali, Indonesia, Sunday, Dec. 2, 2007. World leaders launch marathon negotiations Monday on how to fight global warming, which left unchecked could cause devastating sea level rises, send millions further into poverty and lead to the mass extinction of plants and animals.

combat global warming...

...or risk economic and environmental disaster caused by rising temperatures

www.climatecrisiscoalition.org

P.O. Box 125, South Lee, MA 01260, (413) 243-5665, tstokes@kyotoandbeyond.org, www.kyotoandbeyond.org

3 Democratic presidentional candidates

Democratic presidential candidates former senator John Edwards (from right) and Senators Joe Biden and Chris Dodd before the National Public Radio debate yesterday (12/4/2007).

The UN Seal

An archaic & bureaucratic post WW2 top-down, non-democratic institution that also stands for some good governance values

Superman

One of my favorite childhood heroes and movies

Web-Site on toxic toys

www.healthytoys.org

Batman

One of my favorite super-heroes

Deval Patrick & Denis Guyer

Massachusetts' Governor stands with Dalton's State Rep. Denis E. Guyer.

Bill Cosby & Denis Guyer

TV Star Bill Cosby stands with Denis E. Guyer

Denis Guyer with his supporters

Dalton State Representative

Denis Guyer goes to college

Dalton State Representative

Peter Marchetti

He is my second cousin. Pete Marchetti favors MONEY, not fairness!

Matt Barron & Denis Guyer with couple

Matt Barron plays DIRTY politics against his opponents!

Nat Karns

Top-Down Executive Director of the ELITIST Berkshire Regional Planning Commission

Human Rights for All Peoples & people

Stop Anti-Semitism

Massachusetts State Treasurer Tim Cahill

State House, Room 227, Boston, MA 02133, 617-367-6900, www.mass.gov/treasury/

Massachusetts State Attorney General Martha Coakley

1350 Main Street, Springfield, MA 01103, 413-784-1240 / McCormick Building, One Asburton Place, Boston, MA 02108, 617-727-4765 / marthacoakley.com / www.ago.state.ma.us

Bush v. Gore: December 12, 2007, was the seventh anniversary, the 5-4 Supreme Court decision...

www.takebackthecourt.org - A political billboard near my downtown apartment in Manchester, NH

Marc Murgo

An old friend of mine from Pittsfield

Downtown Manchester, NH

www.newhampshire.com/nh-towns/manchester.aspx

Marisa Tomei

Movie Actress

Massachusetts Coalition for Healthy Communities (MCHC)

www.masschc.org/issue.php

Mike Firestone & Anna Weisfeiler

Mike Firestone works in Manchester NH for Hillary Clinton's presidential campaign

James Pindell

Covers NH Primary Politcs for The Boston Globe

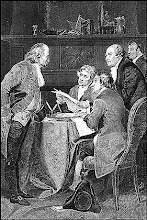

U.S. History - Declaration

A 19th century engraving shows Benjamin Franklin, left, Thomas Jefferson, John Adams, Philip Livingston and Roger Sherman at work on the Declaration of Independence.

Boston Globe Photos of the Week - www.boston.com/bostonglobe/gallery/

Sybregje Palenstijn (left), who plays Sarah Godbertson at Plimouth Plantation, taught visitors how to roast a turkey on a spit. The plantation often sees a large influx of visitors during the holiday season.

Chris Hodgkins

Another special interest Berkshire Pol who could not hold his "WATER" on Beacon Hill's State House!

The Big Dig - 15 tons of concrete fell from a tunnel ceiling onto Milena Del Valle's car.

Most of Boston's Big Dig highway remains closed, after a woman was crushed when 15 tons of concrete fell from a tunnel ceiling onto her car. (ABC News)

Jane Swift

Former Acting Governor of Massachusetts & Berkshire State Senator

Paul Cellucci

Former Massachusetts Governor

William Floyd Weld

$80 Million Trust Fund Former Governor of Massachusetts

Mike Dukakis

Former Governor of Massachusetts

Mary E. Carey

Amherst, Massachusetts, Journalist and Blogger

Caveman

www.ongeicocaveman.blogspot.com

Peter G. Arlos

"The biggest challenge Pittsfield faces is putting its fiscal house in order. The problem is that doing so requires structural changes in local government, many of which I have advocated for years, but which officials do not have the will to implement. Fiscal responsibility requires more than shifting funds from one department to another. Raising taxes and fees and cutting services are not the answer. Structural changes in the way services are delivered and greater productivity are the answer, and without these changes the city's fiscal crisis will not be solved."

James M. Ruberto

"Pittsfield's biggest challenge is to find common ground for a better future. The city is at a crossroads. On one hand, our quality of life is challenged. On the other hand, some important building blocks are in place that could be a strong foundation for our community. Pittsfield needs to unite for the good of its future. The city needs an experienced businessman and a consensus builder who will invite the people to hold him accountable."

Matt Kerwood

Pittsfield's Councilor-At-Large. Go to: extras.berkshireeagle.com/NeBe/profiles/12.htm

Gerald M. Lee

Pittsfield's City Council Prez. Top-down governance of the first order!

Mary Carey

Mary with student

Boston Red Sox

Jonathan Papelbon celebrates with Jason Varitek

Free Bernard Baran!

www.freebaran.org

Political Intelligence

Capitol Hill

Sherwood Guernsey II

Wealthy Williamstown Political Activist & Pittsfield Attorney

Mary Carey 2

California Pol & porn star

Pittsfield's Good Old Boy Network - Political Machine!

Andy "Luciforo" swears in Jimmy Ruberto for the returning Mayor's 3rd term

Berkshire Grown

www.berkshiregrown.org

Rambo

The Mount was built in 1902 & was home to Edith Wharton (1862-1937) from 1903 to 1908.

The Mount, the historic home in Lenox of famed American novelist Edith Wharton, is facing foreclosure.