SARA HATHAWAY

SARA HATHAWAY

----------

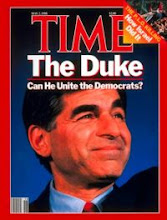

"Don't be fooled again by Ruberto"

The Berkshire Eagle, Letters to the Editor, October 29, 2009

"What is my salary?" This was Jim Ruberto's first question to me when I met with him at City Hall right after the November 2003 election. To me, this question was clear but sad evidence of Jim's first priority as mayor-elect: himself. It also showed me that this was a man who had never looked at a city budget -- the mayor's salary is always the first line item on page one, and could hardly be missed by anyone who had taken the time to crack the front cover of this essential document.

Flash forward to 2009. At the debate on Oct. 26, the moderator asked a question about the "Jobs for Pittsfield" task force that Jim had put in place during his first term. The chair of this task force, Bill Hines, had indicated that 150 jobs per year was a realistic goal for the group, according to the moderator. "Mr. Hines' numbers are not mine," said the current mayor, attempting to distance himself from the claims of his appointee. Indeed. Jim Ruberto had constantly promised voters in 2003 that there would be 200 new jobs, not 150. Although he claimed that he had kept his promises to the people of Pittsfield, I know I am not alone in recognizing that Jim's "straight talk about taxes" and the suitcase he would take on the road to recruit new businesses have helped form a trail of broken promises.

I recognized Jim's hollow promises for what they were in 2003. After he took office, I know that many voters quickly became aware that their new mayor had sold them a bill of goods. Don't be fooled again. Please join me on Nov. 3 in supporting Dan Bianchi, the candidate for Pittsfield's mayor who will bring integrity, know-how and intelligence to City Hall.

SARA HATHAWAY

Pittsfield, Massachusetts

The writer is a former mayor of Pittsfield.

-

www.topix.net/forum/source/berkshire-eagle/THVBAM7HSAVUVLLAJ

-

----------

"Arbitrator orders reinstatement of teachers"

By Dick Lindsay, Berkshire Eagle Staff, May 17, 2011

PITTSFIELD -- The Pittsfield Public Schools must reinstate four teachers and give them back pay for being unduly fired from Reid Middle School two years ago, a state arbitrator has ruled.

In a 63-page decision issued by arbitrator Tammy Brynie, she determined Principal Morgan Williams and his administration failed to properly evaluate a total of six English teachers before Williams let them go after the 2008-09 school year.

However, Brynie only ruled that Nancy Manes, Pam Farron,

Sara Hathaway and Ramsey Stewart be rehired and awarded their salary for one year, less any earnings during that period, according to Pittsfield's labor attorney Fernard Dupere. The total amount owed the teachers has yet to be calculated, city school officials said.

The other two teachers, Susan Conklin and the late Blanche Mednick, were denied compensation and the right to reinstatement because neither had earned their teachers license.

All six educators had three years or less service with the Pittsfield Public Schools.

The school district has 30 days to challenge the ruling in Berkshire Superior Court, and an appeal is under consideration, said Superintendent Howard "Jake" Eberwein III.

Eberwein was "surprised and very disappointed" by the arbitrator's decision, while the city's teachers union was "pleased" an established teacher evaluation process was upheld.

Brynie wrote that the teachers were "significantly and substantially

prejudiced" by the improper evaluations because the evaluations were in violation of the union contract between the United Educators of Pittsfield and the School Committee.

"The decision reinforces our firm belief that the evaluation process needs to be fair and consistent for all our educators," said UEP President Scott Eldridge. "We have an agreed upon evaluation process and it wasn't followed."

Eberwein disagreed, saying he's confident Williams followed the process "perfectly."

"The arbitrator listed several citations in her report of how well [Williams] wrote the evaluations," he said.

In addition, Williams pointed out that Brynie agreed with him that he found several deficiencies in the teachers classroom performance.

While the arbitrator's decision could prove costly for the school district, Eberwein is more concerned about the reinstatement order.

"We didn't renew the contract for six teachers because we clearly don't want them working in our system," he said.

To reach Dick Lindsay: rlindsay@berkshireeagle.com, or (413) 496-6233.

----------

"City must rehire former Reid teachers"

By Jonathan Levine, The Pittsfield Gazette, May 19, 2011

An arbitrator has ordered the city to rehire and provide back pay & benefits for four former Reid Middle School English teachers.

The arbitrator sided with the United Educators of Pittsfield/Massachusetts Teachers Association, determining that the school department violated contractual provisions outlining how teachers must be evaluated.

The ex-teachers were, according to arbitrator Tammy Byrne, “significantly and substantially prejudiced by, among other items, the failure to provide required notice of performance issues and the lack of opportunity to meet [principal Morgan] Williams’ performance expectations.”

A concurrent complaint of discrimination — the teachers were all middle-aged women — remains unresolved under the umbrella of the Massachusetts Commission Against Discrimination.

The arbitrator also determined that two other teachers were unfairly evaluated, but ruled that their failure to complete required certification provided cause for their firing.

The ruling prompted divergent reactions from the union and school department.

Scott Eldridge, president of the United Educators of Pittsfield, said that the union regrets that the case had to go to formal arbitration but has been vindicated.

“We would have been willing to work with the district on this but they felt they were right and we felt they weren’t,” said Eldridge. “Our contract has a set process for the evaluation of teachers without professional status and it wasn’t followed.”

Superintendent Howard “Jake” Eberwein III expressed disappointment with the ruling, which he feels could set a bad precedent statewide.

“The spirit of the evaluation process was absolutely followed,” he said. “This is going to have some real effect... I don’t think it’s the right thing for public education.”

Byrne’s 63-page ruling follows a hearing and the presentation of some 3,000 pages of documents.

The arbitrator outlined how the six teachers had received generally favorable evaluations under former principal Beth Narvaez including “constructive criticism,” “supportive” comments and “informal” observations beyond the formal evaluations.

Williams succeeded Narvaez with a different management style and much less informal contact with the teachers. The arbitrator describes Williams as “a principal with a different perspective and expectations.”

The issue, per the arbitrator, is that the teachers “were never given adequate notice about Williams performance expectations.” Williams allegedly provided less support and failed to attend follow-up observations, during which the teachers could show how they had addressed whatever issues he highlighted following the initial 45-minute observation.

Byrne did not fault Williams’ classrooms observations, but rather his communication regarding them and his decision to have another administrator conduct the follow-up sessions.

“A single observation and receipt of his critical observation notes does not fulfill the employer’s contractual requirement to make specific recommendations for improvement and to provide assistance,” writes the arbitrator.

The decision also highlights that the teachers seemed genuinely shocked to be terminated, suggesting that they did not receive adequate follow up or communication to know their fates had changed.

She specifically determines that the teachers were “substantially prejudiced by their inability to have Williams re-assess their performance.”

Eldridge noted that Narvaez had decided not to renew teachers “and we never fought them on it.” The difference, he said, is that she followed the contractual process and even went beyond the minimum, “giving them opportunities for improvement.”

Eberwein feels that Williams met the contractual process and said that administrators need to be able to terminate new teachers with subpar performance. “We have a very narrow window during which we can determine whether a teacher is of the caliber we require,” he said. “We need to be very critical and aggressive on teachers in the first three years of employment.”

Neither Eldridge nor Eberwein know the particular financial impacts of the decision, which calls for one year of back pay, less any other earnings during the period, as well as benefits compensation.

“To be honest, we don’t have any idea of what the damages are,” said Eberwein.

He added that the school departments’ lawyers will “be tearing apart this arbitration ruling” to identify any modifications needed in evaluation procedures.

Eldridge said it’s not clear whether any of the four former teachers — Nancy Manes, Pam Farron,

Sara Hathaway and Ramsay Steward — will seek the reinstatement. However he stressed that the union will assist them if they accept the reinstatements to ensure they receive placement to a non-hostile environment and get a fair chance at future evaluations.

“The process was not followed,” he said. “Most of the time it never goes this far when administrators don’t follow the contract, but we knew this was a case that had merit.”

Union representatives indicated that no decision had been made whether to continue pursuing the MCAD complaint. That case alleges that Williams’ terminations of the female teachers represents age and gender discrimination.

----------

"Pittsfield school district settles age discrimination complaints; costs unclear: MCAD upholds first allegation of discriminating based on age, rejects gender-based allegation"

By Jim Therrien, The Berkshire Eagle, May 14, 2015

PITTSFIELD - Complaints filed in 2010 with the Massachusetts Commission Against Discrimination against the Pittsfield Public Schools over the dismissal of six teachers — all middle-age women — have been resolved.

The school system has budgeted $200,000 this fiscal year in a line item titled Employee Separation Costs, which a source said is related to the complaints. However, officials declined to release details of any cash settlements, or whether other line items this year or in past years were related to the complaints.

What role the city's liability insurance may have played in the matter also remains unclear.

The six complaints alleged discrimination based on age and on gender, and the MCAD upheld the first allegation while rejecting the second.

Superintendent Jason "Jake" McCandless and others contacted cited confidentiality agreements preventing them from publicly discussing the complaint resolutions.

Mayor Daniel L. Bianchi, an ex officio member of the School Committee, said, "It is my understanding that a claim like this is paid by our insurance policy."

Asked about the $200,000 line item in the school budget, he referred the question back to the school administration.

One of the parties to the action, Pamela Farron, currently serves on the School Committee, having been elected in 2013, while another is former Pittsfield Mayor Sara Hathaway, who served in that post from 2002-04.

Contacted by The Eagle, Farron said she would like to talk about the MCAD complaints but could not because of the agreement. "That was part of it," Farron said.

She also stressed that as a School Committee member since January 2014, she did not participate in any discussions among committee members concerning the MCAD complaints.

As a member of the committee, Farron said, "I have tried to just be an advocate for education."

Hathaway could not be reached for comment.

According to emails from an MCAD official, Hathaway's complaint and that of Susan Conklin were recently settled, and the complaints filed by Farron and Nancy Manes were settled in February.

MCAD documents obtained by The Eagle through a public records request show that complaints by Ramsay Stewart and the late Blanche Mednick, who died in 2010, both were resolved in 2013.

Mednick's estate approved a settlement in January 2013, and Stewart's case was closed in the same month, after a request on her behalf, according to MCAD documents. Stewart could not be reached for comment.

The six non-tenured teachers at Reid Middle School, who were not re-appointed in 2009 after receiving negative evaluations from then-Principal Morgan Williams, filed complaints with the MCAD in January 2010.

An investigation by the MCAD resulted in a split decision in 2012, which found probable cause for a finding of discrimination based on age but a lack of probable cause to support the claim of discrimination based on gender.

Reports on the six individual complaints were filed in 2012 by MCAD investigator and compliance officer Nomxolisi Khumalo. The investigator concluded in part in each that "there is sufficient evidence upon which a finder of fact could form a reasonable belief that it is more probable than not [the school system] subjected the complainant to unlawful discrimination based on age."

Regarding gender discrimination, however, Khumalo concluded in his recommendations that "allegations regarding discrimination based on gender fail ... ."

He noted that in some of the cases the complainant was replaced by a female employee, and that the school's workforce was "comprised of predominantly female employees."

In a disposition notice to the parties sent in July 2012, investigating MCAD Commissioner Jamie R. Williamson agreed with both recommendations in Khumalo's report.

All six complaints are similar in most respects in MCAD documents obtained. The women were in their mid-40s or 50s and had worked in the school for less than three years and had received prior performance evaluations of satisfactory in all or most teaching evaluation categories by Reid Principal Beth Schiavino-Narvaez.

In August 2008, according to the MCAD documents, Williams replaced Schiavino-Narvaez as principal at Reid. After an evaluation process that included observing the teachers in classrooms, Williams gave each negative evaluation reports in 2009 and did not renew their employment.

Williams has since left the school district.

A key factor was that the women were among approximately 25 teachers in the school and 10 in the English Language Arts Department, where the women worked, who lacked "professional status," meaning they did not have permanent employee status and could be dismissed by the principal.

In the district's arguments against the complaints, cited in Khumalo's report, Williams was evaluating the nonprofessional-status teachers with the knowledge that some, if reappointed, would attain permanent status at that time.

The investigator states that the school system asserted: "As a result Williams had to closely evaluate those teachers to determine whether they were good candidates for becoming permanent teachers."

Khumalo lists some of the issues raised by Williams or by John Vosburgh, then-vice principal at Reid, after they had observed the teachers in class. Their notations, upon which Williams based his negative evaluations and decisions not to reappoint the women, included the pace of lessons, confusion among students; students appearing off-task, students talking during an explanation or leaving their desks, or a lack of control over student behavior.

Shortly after the women were not reappointed in 2009, a grievance appeal was mounted through the United Educators of Pittsfield/Massachusetts Teachers Association that resulted in an arbitrator's determination in May 2011 in favor of four of the six women — Farron, Hathaway, Manes and Stewart.

They were ordered reinstated with back pay and benefits for one year, less any other earnings during that period.

The arbitrator concluded that the school system had not followed contractual provisions in evaluating the teachers, primarily relating to failure to notify the woman of performance issues and lack of opportunity to address the issues.

Reinstatement and compensation were not recommended by the arbitrator for Conklin or Mednick, because they had not yet obtained state teaching licenses.

Hathaway, Manes and Stewart later worked in the school system for a time, according to Alex Lomaglio, field representative with the Massachusetts Teachers Association.

Farron returned to Berkshire Community College, where she currently is coordinator of the Disability Resource Center.

Then-Superintendent Howard J. Eberwein was quoted in an Eagle article in 2011 as disappointed with the arbitrator's decision, contending Williams had followed the teacher evaluation process, and he said an appeal of the ruling was under consideration.

However, no appeal to the court system was filed, according to attorney Fernand Dupere, of Westfield, who represented the school system in the arbitration matter. He also said it is his understanding that the settlements related to the arbitration ruling were paid out soon afterward.

Lomaglio said that also is his understanding. "All of the money owed through arbitration was paid at that time," he said.

Eberwein, now dean of continuing education at Massachusetts College of Liberal Arts, could not be reached for comment on the complaint resolutions.

The Massachusetts Teachers Association Division of Legal Services is listed as having filed the six discrimination complaints with the MCAD in 2010. The attorney who signed the complaints, Matthew D. Jones, could not be reached for comment.

Contact Jim Therrien at 413-496-6247. jtherrien@berkshireeagle.com @BE_therrien on Twitter

----------

"Former Pittsfield mayor Sara Hathaway prefers 'Big Harbaugh' in Super Bowl"

By Derek Gentile, Berkshire Eagle, February 3, 2013

PITTSFIELD -- Former Mayor Sara Hathaway will have a definite rooting interest in today’s Super Bowl clash between the Baltimore Ravens and San Francisco 49ers.

That would be Big Harbaugh. You know him as John Harbaugh, coach of the Ravens.

"I think John’s girlfriend at the time came up with Big Harbaugh [for John] and Little Harbaugh [for his brother, Jim, who is 14 months younger]," Hathaway said. "Probably to bug Jim."

Hathaway and John Harbaugh are 1980 graduates of Pioneer High School in Ann Arbor, Mich.

Jim Harbaugh, who coaches the 49ers, graduated from high school in 1982 in Palo Alto, Calif., where the family moved in 1981.

Hathaway, Pittsfield’s mayor in 2002 and ‘03, said she didn’t have any classes with John Harbaugh but saw him a lot.

"It was a pretty big school," she recalled. "Maybe 1,200 kids. I saw him in the hall often."

"I think," she said, chuckling, "that if you took a poll, there would have been widespread agreement that both Harbaughs were hunks in high school."

Hathaway, 51, remembers when Big Harbaugh and his Pioneer teammates wore their football jerseys to class the day before a game, per school tradition. During her sophomore year, Hathaway even was the team’s statistician.

"I went to all the away games as well as the home games," she said.

The former Pittsfield mayor, now a proctor at Berkshire Community College, emphasized that while both Harbaughs went to Ann Arbor Pioneer, there is no doubt who she’ll be rooting for today.

"I think a group of us from the class of 1980 will be on Facebook while we watch the game," Hathaway said. "And there’s no doubt that we’re rooting for the Ravens. Everybody [in her class] loves John."

----------

Seated from left: Former mayor Gerry Doyle, Mayor Daniel Bianchi, and former mayors Sara Hathaway and James Ruberto film a message Friday for Pittsfield’s Irish Sister City of Ballina, Ireland, whose town council will dissolve to join a regional government. (Jenn Smith / Berkshire Eagle Staff / photos.berkshireeagle.com)

"Pittsfield mayor, 3 predecessors unite for love of Ireland"

By Jenn Smith, Berkshire Eagle, 5/24/2014

PITTSFIELD -- How do you get three former city mayors into the same room as the current one? For the love of Ireland.

Mayor Daniel L. Bianchi welcomed his predecessors -- James M. Ruberto, Sara Hathaway and Gerald S. Doyle Jr. -- into his office Friday morning to film, with Pittsfield Community Television, a brief video message of gratitude and solidarity for their fellow delegates in Pittsfield’s Sister City of Ballina, Ireland.

Ballina, located in North County Mayo, about 71 miles north of Galway, will hold its last town council meeting on Thursday. Ballina is one of the many councils that will be abolished as of June, and absorbed into a newly adopted regional governing system.

The sisterhood between Pittsfield and Ballina was established on St. Patrick’s Day, March 17, 1998, through Sister Cities International. Ties and annual delegation visits have been maintained over the years with support from Pittsfield Irish Sister City Committee.

"I thought this would be a nice opportunity for us to come together and wish them well," said Bianchi. "Our hearts and arms will always be open to the people of Ballina."

----------

Letter: ‘Damage to museum, city will not be easily repaired’

The Berkshire Eagle, April 13, 2018

To the editor:

On April 7, an open letter was placed on the Save the Art-Save the Museum Facebook pages and website. Readers were invited to sign if they agreed with it. Within three days, over 300 people had signed, and names are still being added. A complete updated list of signers can be viewed at artberkshires.com.

The goal of strengthening the Berkshire Museum could have united the community as a source of local pride, if the Board of Trustees had transparently and actively sought support and alternative ideas from the public. By promoting its great art collection, the museum could have become a valuable engine for

Pittsfield's revitalization and the city's identity as a vibrant regional arts center.

The museum's present board and staff are not the owners of the amazing art collection that was built over generations for the public. They are merely temporary stewards. True stewardship would have allowed community dialogue and engagement to develop a real strategy to enable the museum to survive and thrive and protect the art at the core of its mission, as well as supporting its other roles.

Unfortunately, the museum leadership chose the opposite course, by secretly pursuing a massive selloff of much of its irreplaceable public art collection. It then rigidly presented it as a stark either/or choice of "sell or close." The suddenness of that announcement last summer, and lack of true engagement with the public since then, aroused dismay and opposition that has been shared by many people — far more widely than those who most actively and visibly opposed it.

The lack of opportunities for true dialogue about the museum's plans also undermined the consensus and momentum of efforts to connect Pittsfield to the Berkshires' cultural life and economy. It has caused needless divisiveness in the community. It also created false dichotomies between old and young, art versus education, science versus culture, heritage versus progress, and "art loving elitism" versus "progressive" populism.

The city's overall revitalization efforts are also collateral damage. The museum's public relations campaign led to portrayals of Pittsfield nationally as a declining community that cannot support its public resources. And the Berkshire Museum's name has become a national symbol of the destructive prospect of institutions selling public art to the highest private bidders in the global art market.

Although the Berkshire Museum has won the legal challenges, its "victory" may become a pyrrhic one. Unfortunately, as the hammer drops at Sotheby's for the sell-off of Pittsfield's artistic heritage, the public trust is also being lost.

The museum now says it's time to come together and "constructively" support its future. Where have they been for the past several years? Why did they brush aside the ideas of a thoughtful and concerned public, and the offers of assistance from experts and organizations?

Is it too late to mitigate the damage? Unless the board truly reconsiders the nature of its plans and engages the public to find a better solution for our community, the damage to the Berkshire Museum and the unfortunate impact on Pittsfield, will not be easily healed.

Margaret Heilbrun,

Housatonic

Grier Horner,

Martha Lenz,

John Townes,

all of Pittsfield

The letter was also signed by the following Berkshire residents: Jeanne Boudreau, Adams; Robert Heilbrun, Alford; Donna Broga, Becket; Margit Hotchkiss, Berkshire; Monique J. Menard, Berkshire; Nora O'Keefe, Berkshire; Ruth Wheeler, Berkshire; Wavelyn Hine, Cheshire;Candice Cimini-Farrell, Dalton; Linda Kaye-Moses, Dalton; Rae Langsdale, Dalton; Dave Martindale, Dalton; Leonardo Quiles, Dalton; Evan Soldinger, Dalton; Daniel Bellow, Great Barrington; Robert Braddick, Great Barrington; Roselle Chartock, Great Barrington; Jane Costa, Great Barrington; Lawrence Davis-Hollander, Great Barrington; Jim Reed, Great Barrington.

Gail Downey, Hinsdale; Lori Flynn, Hinsdale; John Ryall, Hinsdale; Penelope Duus, Housatonic; Prudence Barton, Lanesborough; Chris Erb, Lanesborough; Martha Freedman, Lanesborough; Russell Freedman, Lanesborough; Sandy McNight, Lee; Kristy Sayres Methe. Lee; Joan Bruno, Lenox; Karen Chase, Lenox; Paul Graubard, Lenox; Ani Grosser, Lenox; Lucy Holland, Lenox; Jeanet T. Ingalls, Lenox; Don Jordan, Lenox; Susie Kaufman, Lenox; Mitch Lee Kruszyna; Lenox; Larry Lane, Lenox; Susan Lyman, Lenox; Kim Ostellino, Lenox; Carol Price, Lenox; Roberta Russell, Lenox; Sura Sheldon, Lenox; Richard Taylor, Lenox; Carolyn Wade, Lenox; Elizabeth Weinberg, Lenox; Ellen Arndt Mendel, Lenoxdale.

Andrew DeVries, Middlefield; Ann Getsinger, New Marlborough; Diane Kvidera, North Adams; Katherine Montgomery, North Adams; Patricia Strauch, Otis.

Barbara Arpante, Catherine Beer-Rankell, David Belcher, Morris Bennett; Rose Bohmann, Peggy Braun, Gisele Breton, Aidan Clement, Sara Clement, Bobby Coon, Janice Cullen, Gwendolyn Davis, Joan DiMartino, Evan Dobelle, Kit Dobelle, Paul Dodds, Joe Durwin, Cynthia Gardner, Ken Green, Laurie Green, Kathy Griffin Maconga, Linda Gunderson, Jonathan Hanson, Kyron Hanson,

Sara Hathaway, Drew Herzig, Matthew Hubley, Stephanie Isaak Ricchi, Randy Johnson, Joan Khat O'Brien, Rick Kielman, Fred Landes, Cara Lauzon, Ann Loehr Tyler, June E. Lucido, Steven Mason, Marsha McDermott, Alan Monasch, Arlene Murdock, Marka Neary Deleo, Carl Olson, Chris Post, Lisa Provencher, A.G.Putnam, Dan Pytko, Joanne Quattrocchi, Wendy Rabinowitz, Tom Reardon, Anne Roland, Lucy Sacco, Janet Sallaway, Pat Sanginetti, Susan Sauve, Steve Sayres, Charles Schweigert, Beatrice Selig, Regina Selig Mason, Jill Senecal, Danielle Steinmann, Adell Thomas, Mark Tully, Peter Weissenstein, Judy Williamson, Marion Wolf, Nina Wyskiel Wojcik and Deb Senger — all of Pittsfield.

Karen Carmean, Richmond; Jody Donald, Richmond; Henry Kirchdorfer, Stockbridge; Melanie Kirchdorfer, Stockbridge; Gary Miller, Stockbridge; Sally Underwood Miller, Stockbridge; Celia Kittredge, Tyringham; Cynthia Dillon Payne, Williamstown; Jessica Fisher, Williamstown; Roberta Fortini-Curran.Williamstown; John Stomberg, Williamstown; Stephen Sheppard, Williamstown; Valerie Kohn, Windsor; Monika Sosnowski, Windsor; Michele Dodge, Worthington.

----------

Donald MacGillis

Former Berkshire Eagle Editor Donald MacGillis, 74, who lived in Pittsfield, died Oct. 7 [2020], after falling 50 feet while hiking on Mount Katahdin’s Knife’s Edge Trail with his nephew, Paul MacGillis. The two had become lost in fog before the accident. Photo provided by Alec MacGillis.

"Idea planted for turnpike memorial to ex-Eagle editor MacGillis"

By Tony Dobrowolski, The Berkshire Eagle, November 2, 2020

PITTSFIELD — Former Pittsfield Mayor Sara Hathaway has approached two Berkshire state legislators about the possibility of erecting a memorial to the late Donald MacGillis, a former Berkshire Eagle editor and avid hiker who died last month while hiking on Mount Katahdin in Maine.

Hathaway has suggested planting a new tree in MacGillis’ memory in the place of a dead, broken tree next to “The Berkshires” sign on the Massachusetts Turnpike in Lee. That sign is located near a footbridge that takes the Appalachian Trail across the interstate highway.

“It occurred to me that a prominently placed new tree, near the Appalachian Trail, could be a nice memorial to the late Don MacGillis, if that is permitted on turnpike property,” Hathaway wrote in an email last week to state Rep. William “Smitty” Pignatelli, D-Lenox, and state Sen. Adam Hinds, D-Pittsfield.

Also, the Berkshire Natural Resources Council is considering placing a memorial to MacGillis on one of its properties, but the specifics haven’t yet been worked out.

“I want to talk to Ingrid first and see what she feels is right,” said Jenny Hansell, the council’s executive director, referring to MacGillis’ wife.

MacGillis, 74, who lived in Pittsfield, died Oct. 7, after falling 50 feet while hiking on Mount Katahdin’s Knife’s Edge Trail with his nephew, Paul MacGillis. The two had become lost in fog before the accident.

During his 24-year career at The Eagle, MacGillis served as the paper’s executive editor and editorial page editor, then chaired The Eagle’s advisory board that formed in 2016, after the paper came back under local ownership. MacGillis also worked as an editorial writer for The Boston Globe.

Pignatelli has followed up on Hathaway’s request, asking the state Department of Transportation whether planting a new tree in the vicinity of the sign would be feasible.

“I jumped on it right away,” Pignatelli said. “I don’t know how much a tree costs, but I’m not looking for the state to spend anything. I said we will find a way to get donations. I’m just looking for state approval.

“I’m waiting to hear back from them officially,” Pignatelli said. “They’re going to run it up the flagpole in Boston and let me know.”

“I didn’t know Don well, but he was always so good to my dad,” Pignatelli said, referring to his late father, John J. Pignatelli, a former Berkshire County commissioner who served on the Lenox Select Board for many years. John Pignatelli died in March 2019.

“I’ll never forget him coming to my father’s funeral a few years ago,” Pignatelli said, referring to MacGillis. “I think this is something that would be a great gesture.”

Hinds could not be reached for comment.

Hathaway, who served as Pittsfield’s mayor from 2002 to 2004, was serving as an aide in the state Senate when “The Berkshires” sign on the turnpike was unveiled over 20 years ago.

“The sign and landscaping were George Wislocki’s brainchild, twisting the arm of James Kerasiotes, who paid for the whole thing with MassPike funds,” Hathaway said in her email.

Wislocki is a noted local environmentalist who served as executive director of the Berkshire Natural Resources Council for many years. Kerasiotes is a former state secretary of transportation who served as director of the Massachusetts Turnpike Authority from 1996 to 2000.

“I believe George and Don were friends,” Hathaway said.

Pignatelli said he also is interested in placing solar-powered floodlights around the turnpike sign so that it can be illuminated.

“I just know coming home from Boston I see that sign and I always say this: ‘The air is fresher and the sky is clearer,’ “ Pignatelli said. “And Don being an outdoorsman, I think that would be a very fitting spot, a tribute to a gentleman who really appreciated the outdoors.”

In her email, Hathaway noted that there is a parking area along Route 20 in Lee that leads to a footpath that would provide visitors with access to the site from the north side of the turnpike.

“From what I understand, the newsboy statue in Great Barrington is the only dedicated statue in the U.S. to honor journalism,” Hathaway wrote. “I think we can afford another memorial to a fine person and his good work.”

----------

"Who is Alex Trebek? Western Mass. competitors share memories of late ‘Jeopardy!’ host"

By Francesca Paris, The Berkshire Eagle, November 9, 2020

If the clue is, “A charming professional who hosted a game show for more than three decades,” then the answer is, of course, “Who is Alex Trebek?”

That’s how “Jeopardy!” contestants from Western Massachusetts described Trebek, the longtime program host who died Sunday. He was 80.

“It’s hard to imagine the show without him,” said Sara Hathaway, a former mayor of Pittsfield who went on the show in the mid-1990s. “You could tell he was bright, and that he was really engaged in the production.”

Trebek hosted the show for 36 years, starting with its 1984 reboot. After announcing his stage 4 pancreatic cancer diagnosis last year, he continued to work on the show through several rounds of chemotherapy. And as fans mourned the loss of the Canadian-American TV icon, former contestants remembered him as focused, kind and, at times, a bit of a perfectionist.

Hathaway told The Eagle that producers would keep Trebek separate from contestants until the cameras started rolling. Once filming started, she said, he would avoid doing anything that might give the impression he was playing favorites.

“He just had to be very neutral,” Hathaway said. “He can’t wink at you, or give you a hint, or anything like that.”

Recent competitor Kirsten Rose agreed: “He was all business.”

Rose is a librarian at the Milne Public Library in Williamstown and a lifelong “Jeopardy!” fan. She got the call that she had nabbed a spot as a competitor in March 2019 — the same week that Trebek announced his cancer diagnosis. They filmed her episode later that month.

While Trebek would go on to speak publicly about the challenges of hosting with cancer, including episodes of intense pain and sores in his mouth that made it hard for him to talk, Rose said it was impossible at the time to tell that he was struggling.

“I had no idea whether he felt terrible the day I was there, because he was such a professional,” she said. “He wouldn’t have let anybody see that.”

During the breaks, she remembered, he would chat with the audience, graciously handling questions that he must have been asked a thousand times already.

“He had a very dry sense of humor, a very dry wit,” Rose said. “Which didn’t always come out on TV.”

He also would use those breaks to redo questions that he had flubbed, Rose said, and she noted that he did several takes for each line.

“He had an ideal in his head,” she said. “If he didn’t make that mark, he was going to do it again and again, until he got it right by his standards.”

Decades of hosting the show gave Trebek a fine-tuned radar for good television content. During the brief one-on-one chats with contestants, Rose said, he would come up with a notecard in hand and choose among several fun facts about the person in front of him.

“He knew what kind of things would appeal to the audience, and how to draw that out of people,” she said.

Trebek would loosen up a bit during credits, contestants remembered. Rose, who struggled with the buzzer during her game, said he was particularly kind when she lost.

“When the music rolled, he walked over to us and said, ‘I could see that you knew a lot of those and you just couldn’t get to the buzzer in time,’” she said. “It was nice to have him acknowledge that.”

Chicopee native Tom Nichols, a professor at the U.S. Naval War College, won a string of episodes that aired in 1994, and he returned to the show several times, including for the 2005 Ultimate Tournament of Champions.

His fondest memory was surprising Trebek when he was the only contestant to give the correct answer to a Final Jeopardy question about a 19th-century actress. During the credit music, as the cameras still were rolling, one competitor asked Nichols how he knew the answer.

“Then [Trebek] leaned over and said quietly, ‘Yeah, how did you know that?’” Nichols said. “It was the only time he broke character.” (The question was about British actress Laura Keene, and the answer was the play “Our American Cousin.”)

Tom Nichols on Jeopardy

Tom Nichols, a native of Chicopee, won several “Jeopardy!” games that aired in 1994. The show’s longtime host, Alex Trebek, died Sunday.

For his part, Trebek liked to see contestants succeed, and he spoke often about how much he enjoyed his job.

“I love spending time with bright people,” he told NPR in 2016. “And “Jeopardy!” puts me in touch with bright folks all the time.”

While Trebek could be more casual in person than on television, Nichols said, most of the time the host was “very Canadian — cool and polite, a real professional.”

Even with years of experience, Trebek still had trouble pronouncing some of the unusual names that came up, Nichols said, and producers would have to pause until he could get it right. But, for the most part, the show operated like a machine; when Nichols appeared on the program, there were no chats with the audience, and Trebek might shoot five episodes a day with just a 10-minute break between each.

Despite the breakneck filming pace, Nichols added, it was a joy to watch him work.

“He was a very reassuring presence onstage,” Nichols said. “When he came out, you knew the show was up and running.”

----------

"Candidates emerge in Pittsfield elections as nomination deadline passes"

By Amanda Burke, The Berkshire Eagle, July 16, 2021

PITTSFIELD — The deadline to return nomination papers passed on Friday, and the field of candidates for School Committee and City Council appears to be set.

And on the deadline to return signatures to the Registrar of Voters, former Mayor Sara Hathaway returned paperwork to run for School Committee. The former teacher, whose papers must still be certified, said she’s considered running for a seat on the committee for years, and felt it was the right time to run.

“I’ve thought about it off and on for years, and I decided there’s no time like the present. After the pandemic, I thought, ‘How can I reconnect with the community?’ and this seemed like a good way,” she told The Eagle Friday. “I’m not getting into this because I have an axe to grind on any particular issue; I felt that this was a way to serve the community, and my City Hall experience and my teaching experience could be useful.”

Friday was the deadline for candidates to submit proof they had gathered enough signatures to appear on the ballot.

In the School Committee race, incumbents Dan Elias, Bill Cameron, Alison McGee, Mark Brazeau and Nyanna Slaughter, who was appointed to the committee to fill a vacancy in April, are certified candidates. Longtime committee member and Chairwoman Katherine Yon did not pull papers to run for another term.

Also running for a seat on the School Committee are certified candidates Katie Louzon and Karen Reis Kaveney Murray. Bill Tyer returned paperwork to run for the committee on Friday, but like Hathaway, still needs his paperwork to be certified. There are six seats available.

There are not enough candidates running for City Council or School Committee to trigger any preliminary elections this year. The General Election is on Nov. 2.

Vying to replace outcoming Ward 1 Councilor Helen Moon are Kenneth G. Warren Jr and Andrea Chris.

The candidates in the running for the seat currently held by Ward 2 Councilor Kevin Morandi, who also is not seeking reelection, are Charles I. Kronick and Matthew Ryan Kudlate. Traffic Commission member Nicholas Russo, who pulled papers to run for the seat, announced he would not be moving forward with his bid.

Kevin Sherman, the former City Council president, is the sole candidate running in Ward 3 to replace Nicholas Caccamo, who is not seeking a fifth term in office.

Over in Ward 4, the candidates hoping to succeed Councilor Chris Connell are James B. Conant, chair of the Conservation Commission, and Andrew M. Wrinn. Courtney N. Gilardi pulled nomination papers to run for the seat but did not return them by the deadline, according to Beth Martin, the assistant clerk for registration and elections.

As the only candidate in Ward 5, incumbent City Councilor Patrick Kavey will sail without a challenger to a second term in office. So, too, will Ward 7 City Councilor Anthony Maffuccio, whose only would-be challenger, Nolan Smith Fernandez, did not return his nomination papers.

Edward Carmel, a member of the Homeless Advisory Committee and Human Services Advisory Council, is for the second time challenging Councilor Dina Guiel Lampiasi in Ward 6.

In the City Council’s at-large race, all four incumbents — Peter Marchetti, also the council president, Yuki Cohen, Earl Persip III and Pete White — are certified candidates seeking reelection. The remaining certified at-large candidates are Craig Benoit and Karen Kalinowsky.

Pittsfield High basketball coach Brandon Mauer announced in July he was withdrawing from the at-large race. City Clerk Michelle Benjamin is running for another term unopposed.

Candidates must file certified papers with the City Clerk by July 30 [2021], and the official candidate list will be posted after that.

----------

Sunday, July 18th, 2021

Dear blogger Dan Valenti and Planet Valenti blog readers and/or blog posters,

The Berkshire Eagle's Pittsfield politics reporter wrote yesterday that former Mayor Sara Hathaway submitted nomination papers to run for Pittsfield School Committee. How would her position as a Pittsfield public school teacher limit her votes on the Pittsfield School Committee? Would this be a conflict of interest?

I have a blog page about Sara Hathaway. Prior to the November city election in 2009, she wrote a letter to the editor of the Berkshire Eagle against then Mayor Jimmy Ruberto in favor of Dan Bianchi. I agreed with her letter where she pointed out that Jimmy Ruberto never looked at a city budget prior to 2004 when he became Mayor, his promises of bringing in hundreds of jobs via his so-called "Rolodex" and recruitment efforts turned out to be a joke, and that all of his 2003 campaign promises were "hallow" and he sold Pittsfield voters "a bill of goods".

In mid-May of 2011, an Arbitrator ruled that Sara Hathaway (and several other middle-aged women English Arts Department Pittsfield teachers) had to be reinstated with back pay after she (and others) were unduly fired after the 2008 - 2009 school year. The rationale was the use of improper evaluations by Pittsfield public school Administrators. However, the Arbitrator agreed with the Administrators' findings of deficiencies in her (and the others) classroom teaching performance. Sara Hathaway (and the others, who were all middle-aged women Pittsfield public school teachers) made complaints of discrimination to the Massachusetts Commission Against Discrimination, which upheld discrimination based on age, but rejected the gender-based allegation by mid-May of 2015. The city had confidentiality agreements and the MCAD-based claims against the City of Pittsfield were paid by the city's insurance policy during the tenure of then Pittsfield Mayor Dan Bianchi. Sara Hathaway could not be reached for comment in mid-May 2015 after her age discrimination claim against the City of Pittsfield was settled.

In April of 2018, Sara Hathaway signed onto an open letter, along with over 300 people, to Save the Berkshire Museum/Save the Art, arguing that public trust would be lost by the sales of tens of millions of dollars of historic artwork. Her 2003 opponent for Mayor of Pittsfield, Jimmy Ruberto, led the campaign to sell the historic artwork.

My personal feelings about Sara Hathaway are double-edged. On the one hand, she warned us about Snake Oil Salesman Jimmy Ruberto in 2003, and her warnings were totally accurate that Jimmy Ruberto would screw over Pittsfield with all of his false promises. On the other hand, she came to power in 2001 on the blessing of a then Pittsfield State Senator and current politically-connected Marijuana Attorney (whom I am not allowed to say his name on Dan Valenti's awesome blog [Andrea Francesco Nuciforo Junior]), which meant that Sara Hathaway was nothing more than a political hack back in 2001 - 2003. When the aforementioned then Pittsfield State Senator [Andrea Francesco Nuciforo Junior] had to step down from Beacon Hill in 2006 because he was in bed with Boston's big banks and insurance companies, he strong-armed Sara Hathaway and another woman candidate named Sharon Henault out of the 2006 state "election" for Pittsfield Registrar of Deeds, which was criticized by both The Berkshire Eagle and The Boston Globe newspapers.

In closing, I admire Sara Hathway for her accurate warnings about Jimmy Ruberto in 2003 and her various stands against Jimmy Ruberto through 2018. But, she started off as a political hack, which makes her a hypocrite in Pittsfield politics over the past 20 years.

In Truth!,

Jonathan A. Melle

----------

"Candidates for city, school positions to meet in NAACP debate"

By Meg Britton-Mehlisch, The Berkshire Eagle, October 5, 2021

The Berkshire County chapter of the NAACP will host a candidates forum for City Council candidates and School Committee candidates on Wednesday and Thursday evening.

Former NAACP chapter president Will Singleton will moderate a candidates forum for the City Council At-Large candidates on Zoom at 6 p.m. on Wednesday. On Thursday at 6 p.m., Singleton will lead a Zoom conversation with candidates for Pittsfield School Committee candidates.

Both forums will be simulcast on PCTV and Facebook according event listings by the Berkshire County NAACP. The events can be found on the branch’s Facebook page or naacpberkshires.org.

There are six candidates for the four At-Large positions: Council President Peter Marchetti, incumbent Yuki Cohen, Earl Persip, Peter White and new candidates Craig Benoit and Karen Kalinowsky.

As with the City Council race, most of the candidates vying for the six School Committee spots are incumbents.

Incumbents Dan Elias, Bill Cameron, Alison McGee, Mark Brazeau and Nyanna Slaughter, who was appointed to the committee to fill a vacancy in April, are back on the ballot along with Sara Hathaway, Katie Lauzon, Karen Reis Kaveney Murray, Nicky Smith and Billy Tyer.

Longtime committee member and Chairwoman Katherine Yon is not seeking reelection.

Staff reports

----------

October 11, 2021

Pittsfield's "Level 5" School Committee has 6 seats plus Mayor Linda Tyer that takes in many millions of dollars in state administered federal funding, but no one knows where the money actual goes - meaning it's millions in funding is all really a "Cash Cow" for Pittsfield politics instead of for public education.

What is worse is that everyone - faculty, staff, including former Pittsfield Superintendent Jason "Jake" McCandless who now works in Williamstown, and over 650 students - all choose to bolt from the Pittsfield public school district faster than the Jamaican sprinter Usain Bolt can run the 100 meter dash. Retired Superintendent Bill Cameron knows all about Pittsfield's failing public schools, but he always votes for business as usual, which has long been Pittsfield politics' sarcastic tagline.

Sara Hathaway, along with 5 other women teachers, received an unspecified cash settlement from the Pittsfield public school district's insurance policy for age discrimination in the Spring of 2015 - or 6.5 years ago when Dan Bianchi was the Mayor. I must give due credit to Sara Hathaway for her rightfully opposing Pittsfield politics' worst snake oil salesman Jimmy Ruberto since 2001 - or for the past 20 years. Sara Hathaway was right about him long before most people learned the hard way. I wonder how many votes she will receive for School Committee in the November election? I also wonder how she would work with Mayor Linda Tyer, seeing how they are on opposing sides of Pittsfield politics?

Jonathan A. Melle

----------

"With a new School Committee makeup, parents and teachers hope for a more communicative relationship"

By Meg Britton-Mehlisch, The Berkshire Eagle, December 30, 2021

PITTSFIELD — As the Pittsfield School Committee says goodbye to two members and welcomes former mayor Sara Hathaway and educator Vicky Smith to the group, parents, educators and district staff are asking for more communication and face time with committee members in the new year.

“I’m hopeful that this School Committee will be more involved in the community and really hear what they have to say — parents and students,” Melissa Campbell, a Herberg Middle School teacher and president of the United Educators of Pittsfield said at a listening session with Hathaway and Smith at the Berkshire Athenaeum on Wednesday night.

“Teachers tend to have a voice and we hope that we’re advocating for our parents and families but it is really important to really collaborate with people as well,” Campbell said, adding that she feels there’s been a disconnect between the community and district decision-makers.

Hathaway and Smith, who won election to the committee in November, said they felt the distance as well noting that the realities of running an election campaign had kept them from much door-knocking or having a chance to talk with district families and employees in person.

During the hour-and-a-half listening session, the incoming committee members took the pulse of the district, hearing from Campbell and UEP executive board member and Egremont Elementary teacher Karen McHugh as well as Andrea Schaller, a district parent and Williams Elementary School Council member.

Schaller said that she and other parents are looking for guidance on when and to whom to bring their concerns over topics like in-person learning during the pandemic, reinstating middle school math honors programs and fair wages for district teachers, paraprofessionals and support staff.

Hathaway and Smith said they’d look into communicating clearly with families about how to get in touch with school principals, district administrators and the school committee. They also said they’d be interested in “meeting people where they’re at” and doing in-school visits with students, attending PTO and school council meetings and hosting further listening sessions.

Campbell said that teachers would roundly support having School Committee members increase school and classroom visits and see how students and teachers are fairing as they navigate rigid curriculum, state testing and performance pressures and the added stressor of the coronavirus pandemic.

McHugh and Campbell both pushed the members-elect to advocate for more autonomy for teachers to supplement school curriculum, focus less on standardize testing and carve out dedicated spaces for students to focus on their social-emotional skills.

Campbell said that greater autonomy for teachers might be the key to district concerns about teacher rollover and students’ and families’ decisions to attend other school districts.

“We’re all here because our main concern is the children in our community; we want to see them grow and be successful and productive and reach their highest potential,” McHugh said. “It’s not just one segment of the community that can do that. It has to be all of us.”

----------

"New members of the Pittsfield City Council and School Committee are sworn in"

By Meg Britton-Mehlisch, The Berkshire Eagle, January 3, 2021

PITTSFIELD — City municipal and school leaders for the next two years took their oath of office in an inauguration ceremony at Berkshire Community College on Monday morning.

The 11-member Pittsfield City Council, six-member School Committee and city clerk swore to uphold their duties to the residents of the city before a gathering of family, friends, city department heads and local politicians.

City Clerk Michele Benjamin officiated the ceremony — following her own swearing in for a third term as clerk — in the college's Boland Theater. City officials said last week that the inauguration event was moved from its traditional spot in City Hall to the theater to allow for better social distancing between attendees.

New School Committee members Sara Hathaway and Vicky Smith joined the returning members Mark Brazeau, Bill Cameron, Dan Elias and Alison McGee in the oath of office.

Five new councilors joined the City Council's incumbent members: At large City Councilor Karen Kalinowsky, Ward 1 Councilor Ken Warren, Ward 2 Councilor Charles Kronick, Ward 3 Councilor Kevin Sherman and Ward 4 Councilor James Conant.

At large City Councilors Earl Persip III, Peter Marchetti and Pete White, and Ward 5 Councilor Patrick Kavey, Ward 6 Councilor Dina Lampiasi and Ward 7 Councilor Anthony Maffuccio renewed their oaths of office.

<Photo>

Pittsfield City Clerk Michelle Benjamin swears in members of the School Committee on Monday at Berkshire Community College's Boland Theater. credit: Ben Garver - The Berkshire Eagle.

City Clerk Michelle Benjamin swears in members of the Pittsfield City Council on Monday at Berkshire Community College's Boland Theater. credit: Ben Garver - The Berkshire Eagle.

Members of Pittsfield City Council recite the pledge of allegiance before being sworn in Monday during a ceremony at Berkshire Community College's Boland Theater. credit: Ben Garver - The Berkshire Eagle.

Meg Britton-Mehlisch can be reached at mbritton@berkshireeagle.com or 413-496-6149.

----------

"Pittsfield Public Schools outlines preliminary budget, asking for an additional $5.9 million for the upcoming school year"

By Matt Martinez, The Berkshire Eagle, March 24, 2023

Pittsfield Public Schools will ask for an additional $5.9 million for the upcoming school year, with more than 80 percent of that increase going toward special education, vocational education and contract obligations.

Leaders from the schools this weekpresented the early budget to the Pittsfield School Committee, with department heads and principals stressing the necessity of some of the requests. This preliminary budget will be studied and analyzed at a number of future meetings, with the hope that it will ultimately be presented on April 26 for a final vote from the committee, Superintendent Joseph Curtis said.

The Pittsfield School Committee will meet for a public hearing on the budget at 6 p.m., Monday, March 27 [2023].

The extra $5.9 million represents an 8 percent increase in the budget over last year’s City Council appropriation. About $3 million of the increase is going to recently negotiated contract obligations for employees represented by the United Educators of Pittsfield, American Federation of Teachers, Pittsfield Educational Administrators Association and for non-bargaining employees.

Another roughly $1.4 million is earmarked for special education teachers and paraprofessionals, as well as five bus monitors and two board-certified behavior analysts.

Over half a million dollars will go toward additional spending for career and technical education now that Taconic High School has become a fully vocational school. That money will add three new teachers and three new paraprofessionals, as well as a coordinator.

The district is still working on adjusting to the termination of federal Elementary and Secondary School Emergency Relief spending at the end of the next school year. That money was meant to provide schools with assistance during the COVID-19 pandemic, with a focus on support roles to help students adjust after returning to school.

From that relief program, the district has just less than $4 million remaining, which will go toward a number of positions for literacy coaches, teachers of deportment and social-emotional learning.

Positions for six teachers of deportment across the schools were included for the budget, resulting in about $390,000 in salaries. In turn, six student support paraprofessional positions were removed, saving the district $210,000.

Candy Allessio, principal at Crosby Elementary School, presented statistics about the usefulness of teachers of deportment, explaining that Crosby’s creation of Room 30, a place students are sent for behavioral referrals, has been a dramatic benefit.

Allessio said students can be referred to Room 30 for a chance to calm down and get a break from whatever is bothering them. The teachers of deportment use a four-step process and work individually with students on what they need, she said.

“What this is really doing for us in our building is keeping our students in classrooms,” Allessio said. “They’re getting educated, they’re not spending a lot of time at home. As you can see, the intervention referrals are going up — and that’s what we want to see, because we want the chance to work with our students — and our suspension rate is going down.”

Kerry Light, principal at Conte Community School, advocated for her school to get two teachers of deportment, explaining the need to have two separate options, one for students from pre-kindergarten to second grade, and the other from third to fifth grade.

“Right now, they’re all in the same room together — imagine a fifth grader with a 3-year-old,” Light said. “If you have a 3-year-old who is in distress ... it could take hours to calm them down and a lot of one-on-one support.”

Members of the School Committee weighed in on the presentation of facts from district leaders, mostly remarking that they needed more time to digest the line items on the budget before commenting further.

Some, however, applauded the presentations on social-emotional learning needs from the pandemic.

“There are expenses that are real, and they’re 21st-century expenses, and they’re also just the right thing to do,” committee member Sara Hathaway said. “Building a culturally responsive school system is the right thing to do.”

-----

March 25, 2023

There are strong economic indicators of an upcoming recession. What is Pittsfield politics' position on the possibilities of an economic downturn? The answer is a proposed increase in the Pittsfield public school district's proposed fiscal year 2024 budget of $5.9 million - 8.17 percent - over fiscal year 2023. The School Committee will be holding a public hearing on the proposed budget this upcoming Monday evening, March 27th, 2023, at 6pm. $78 million for Pittsfield's Level 5 public schools, a predicted recession, and Pittsfield politics' decades of failed leadership on public education (along with everything else) sounds a bit too much for my view of economic and financial reality!

Jonathan A. Melle

-----

"What is your housing plan?"

The Berkshire Eagle, Letter to the Editor, April 28, 2023

To the editor: In March 2022, 1Berkshire and the Berkshire Regional Planning Commission published "A Housing Vision for the Berkshires," addressing the shortage of decent housing at all levels — affordable, workforce and market rate.

Which of the specific and concrete strategies in that report will you commit to advancing for Pittsfield?

Choices include (but are not limited to): Establish a rental inspection program; use Community Preservation Act funds to support development; create a room-occupancy tax on short term rentals to support development; recruit housing advocates to serve on permit-granting and development review committees; amend zoning rules to allow more forms of housing "by right" (instead of by special permit); implement the 2008 "Getting Home" plan to end homelessness; identify residentially zoned land served by utilities that could be rezoned for denser housing or mixed use development.

How would you address neighborhood opposition to the development of new housing?

Sara Hathaway, Pittsfield

-----

School Committee member Sara Hathaway speaks against a petition to raise the age of elected committee officials to 30.

Level 5 public School Committee Member Sara Hathaway opposed Ward 2 City Councilor Charles Ivar Kronick's petition for an age requirement to be eligible to serve on the Level 5 public School Committee. I, Jon Melle, would ask: "What the Hell is the difference? Pittsfield's Level 5 public schools are the definition of rock bottom! Over 650 students opt out of the Pittsfield (Level 5) public school district per academic year."

"Pittsfield Council Files Age, Term Limit Petition" / iBerkshires.com - June 15, 2023 - The Berkshires online guide to events, news and Berkshire County community information.

-----

June 15, 2023

Hello Charles Ivar Kronick,

I read your post about Sara Hathaway's comments to the City Council that opposed your proposal to institute an age requirement for the School Committee in Pittsfield politics. From what you wrote, she came across as negative of you and your idea.

The Sara Hathaway Hack over the years...

Sara Hathaway is not from the Pittsfield area, but she moved to Pittsfield after she was hired as a planner with the useless Berkshire Regional Planning Commission in the mid-1990s. In 1997, Sara Hathaway went to work for the then new "Democrat" "Pittsfield" State Senator (who really lived in Boston) Andrea Francesco Nuciforo Junior, whose late-father was also a Pittsfield State Senator many years ago.

When my dad, Bob, was a Berkshire County Commissioner, he called "Luciforo's" Pittsfield district office, and Sara Hathaway rudely said to my dad, Bob, "What do you want?" During the Spring of 1998, Nuciforo tried to jail me by telling the Pittsfield Police Department that if I entered his Onota building North Street district office, his staff were to call the police and I would be arrested on the spot. My dad found out about this not from Nuciforo, but at his work in the Pittsfield courthouse.

In 2001, Sara Hathaway ran for Mayor of Pittsfield and she won her first and only term as Mayor. Of course, we all know all too well that Pittsfield is a distressed postindustrial city that is always in the top 10 cities in Massachusetts for violent crime. Mayor Sara Hathaway called violent crime in Pittsfield an "aberration". Other Sara Hathaway statements include that "Pittsfield is a junky for state aid". To her credit in 2003, Sara Hathaway correctly warned us about Jimmy Ruberto's false political ambitions to oust her as Mayor of Pittsfield, which Mayor James Ruberto served in from 2004 - 2011.

Sara Hathaway is a member of the Pittsfield Democratic City Committee. Sara Hathaway went on to be a middle school teacher at Reid Middle School in Pittsfield. In 2006, Sara Hathaway took out nomination papers to be the Pittsfield Registrar of Deeds. But also in 2006, "Luciforo" had to step down from his elected position as "Pittsfield" State Senator because he was allegedly illegally double dipping as the Chairman of the State Senate Finance Committee while also serving as an Attorney for Boston's Financial District's big banks and insurance companies for the Boston law firm "Berman and Dowell". "Luciforo" strong-armed Sara Hathaway, along with Sharon Henault, out of the 2006 state government "election" to anoint himself to the no show plum 6-year sinecure.

As the years passed, the Pittsfield Public School district tried to fire Sara Hathaway from her teaching position, along with several other middle-aged women teachers. Sara Hathaway and the other teachers filed various complaints. Sara Hathaway was ordered to be reinstated to her teaching position. Sara Hathaway also received an undisclosed financial settlement from the city during the Dan Bianchi administration.

In recent years, Sara Hathaway is a member of the Pittsfield School Committee. Sara Hathaway is politically active in Pittsfield politics. For years, Pittsfield's public schools have received the worst rating from the state, which is Level 5. It is fitting that Sara Hathaway is a middle school teacher and a member of the Pittsfield School Committee because in my book, she rates as a Level 5 person, teacher and politician!

Jonathan A. Melle

-----

The Pittsfield Affordable Housing Trust holds a public hearing Wednesday [June 21st, 2023] to take community input.

"Exorbitant Housing Prices, Limited Options for Pittsfield Residents"

By Brittany Polito, iBerkshires Staff, Sunday, June 25, 2023

PITTSFIELD, Mass. — Local leaders highlighted housing needs at a public input meeting with the Affordable Housing Trust on Wednesday.

During the public hearing, trustee also heard of residents' struggles with housing that ranged from homelessness to being locked into long-term renting because they cannot afford a home.

This was the body's first event of this kind at Conte Elementary School.

The city allocated an initial $500,000 in American Rescue Plan Act funds for the trust and was allocated $150,000 in Community Preservation Act funds for the fiscal 2024.

"I think affordable housing at this point, in the country honestly, too, is an oxymoron," said Chair Betsy Sherman, also executive director of the Christian Center. "It depends on how you define that."

She said the trustees looking to have safe and comfortable housing for residents and that a home is the first step of movement for an individual or a family.

"And safety for me, that's one of the prime things that I look for," she added. "People can have a life. That this will allow somebody to move into whatever is built and be able to live comfortably. Be able to afford transportation, be able to move up in terms of getting a job, getting a better job, getting child care, all the things that go around living a life."

Michael Hitchcock, co-director of non-profit Roots and Dreams and Mustard Seeds, said the median income is $60,000 a year, so half of the population is below that.

He believes that there should be an investment in cooperatively owned housing along with zoning changes that should allow taller buildings to accommodate more housing units.

Hitchcock pointed out that a vast majority of people are earning something close to minimum wage, taking in around $450 a week.

"So you're talking about $1,824 a month. Everybody who's ever tried to rent, notices that you have to earn three times the rental income to be approved and you need a good credit score. So guess what? An apartment for a person earning minimum wage working 32 hours a week has to be $600 a month," he said.

"What's the average apartment going for right now in Pittsfield? $800 to $1,200. I saw one on Brown Street for $2,400."

Hitchcock said these prices make housing inaccessible to many citizens while if you're above the $60,000 a year, "most of these things will be invisible to you. You just cannot see them and it's not your fault. You need to be told because you haven't experienced it."

He added that people below the median are left with only a few hundred dollars for expendable income at the end of the month after paying the costs of living.

"So when you're talking about affordable housing, you have to remember you're talking about people. You are making a policy for the vast majority of people who have no choice," Hitchcock said.

His solution is cooperative housing because it allows for public/private investment and gives those involved the benefit of stability of ownership without the extreme high price because it's a shared cost.

School Committee member Sara Hathaway she's been trying to come up with ideas for school employee housing.

The district is currently undertaking a restructuring study to assess the physical and educational needs of Pittsfield Public Schools. It could result in consolidating schools due to enrollment changes and redistricting, after hearings for community input.

"We do not need as many buildings as we have. Probably this building. This could be your living room," she said. "Obviously we want to have the right buildings to serve the population and a fair distribution around the city but likely some buildings will become vacant, some buildings will be repurposed. ...

"What we would like to do is to redevelop some of these surplus buildings as housing for Pittsfield teachers, paras, and maintenance administrators."

School officials are interested in speaking with the decision-makers on the housing side to understand how such a project could be funded.

The former mayor moved to Pittsfield decades ago from Nantucket and rented a two-bedroom apartment on Boylston Street for $385 a month.

"I remember thinking I'll take two [bedrooms] because it was so inexpensive and I know that that's just not happening anymore," she explained. "I'd be curious to knock on the door and ask the people who live there now 'What are you paying?' as I know that's just impossible."

The Elizabeth Freeman Center's Director of Programs Jennifer Goewey asked the board to consider the economic impact of violence and what it means for survivors when they flee.

"Every day we are working with people in this community who we either have to push into a sheltering system or we need to relocate into another community and they can't stay in their own community and rebuild and live a life that's free of violence," she said.

"The affordable housing shortage in Pittsfield and Berkshire County, we are countywide, has been an enormous strain on us and our clients, which also intersects with so many of the people I recognize here today."

She pointed out that if a person's basic needs are not met, they cannot do anything else.

"And so whether you're doing our work, which is helping people to live a life that is safe and free from violence, or mental health is your niche or you're an educator, housing, whatever it is, food stability, it doesn't matter," Goewey said.

"It starts with housing."

One of the biggest reasons that a person stays in an abusive situation is the threat of not having a place to stay, she said, or having children taken away because they don't have a home after leaving an abusive partner.

"So just keep in mind not only the economic impact of islands and the trade-offs when someone is trying to obtain safety but also, please remember that for those who are most oppressed and vulnerable, including being homeless, the rates of victimization is really really high," she said.

Social worker Soncere Williams, who has taken out papers to run for City Council in Ward 2, spoke to the rising tax rates that affect homeowners on a fixed income.

"A lot of these ideas that we're talking about, these plans are really great but theoretically how long are they going to take and what are we going to do in the next five, six, seven years, 10 years while we develop these plans?" she asked.

"People are still going to remain houseless, people are still going to be struggling, being evicted. People are going to be doubling, tripling, and quadrupling up."

Alisa Costa, another City Council candidate, for a at-large seat, said the housing is "very different" from Albany, N.Y., where she previously lived.

"I was fresh out of college able to get three roommates and move into the bottom half of a Victorian house and share living expenses in the apartment. I don't think I have seen any places that have four bedrooms that aren't single-family homes in Pittsfield," she said.

"We were able to share the rent so thinking about different housing models. Right now I think we're only building up to two-bedroom apartments and given the wages in the area, it isn't sustainable and so we have to think of different housing models and not that we're going to be living alone or just our family."

She also asked the board to think about equity in terms of applying for housing, pointing out that credit scores, application questionnaires, and high upfront costs that often exclude people from the process.

"Those are huge barriers to even entering any kind of housing opportunity," Costa said.

-----

Letter: "Rhonda Serre for Ward 7 City Council"

The Berkshire Eagle, September 14, 2023

To the editor: How lucky can one ward be?

We are so lucky that Rhonda Serre has agreed to step up and represent Ward 7.

Rhonda and I first met as district aides for state legislators from the Berkshires. She went on to work for late U.S. Rep. John Olver, then became the MassDevelopment liaison for the Berkshires. She has worked in Pittsfield public school classrooms and for Elder Services. Currently, she volunteers on the Ordinance Review Committee for the city.

Aside from her relevant and abundant experience, Rhonda is a great person: cheerful, smart and a devoted friend. She will be a respectful colleague and a thoughtful and dedicated representative for her constituents.

Ward 7, please join me in voting for Rhonda on Tuesday. Please step up. She needs your vote.

Sara Hathaway, Pittsfield

The writer is a member of the Pittsfield School Committee and a former mayor of Pittsfield.

-----

Letter: "Marchetti surrounds himself with forward-thinkers and problem-solvers"

The Berkshire Eagle, November 2, 2023

To the editor: It had been years since Gerald Coppola and I had crossed paths, but we saw each other at Peter Marchetti’s campaign event in August.

It’s always nice to feel you’ve made the right choice of candidate when you see a respected friend has bet on the same horse.

At that event, Jerry told me that Highway Superintendents’ Association members found it difficult to locate and hire people to operate the equipment used to repair and plow Western Massachusetts roads. As I was now on the Pittsfield School Committee, he hoped I could spread the word about a Mass DOT training program leading to careers in highway and road construction.

When I inquired at the Pittsfield Public Schools, I learned that highway superintendents would be a welcome addition to an existing advisory group of trades representatives. Both the highway superintendents and students would benefit as students could find out more about the training program and scholarships available through the state Department of Transportation.

The chance encounter at Pete Marchetti’s event and the constructive outcome are the points of this letter: Peter has a network of friends who come together and solve problems. These are the people who surround Pittsfield’s next mayor, and we are all working with Pete to make life better in this community.

Please vote for our friend Pete Marchetti on Nov. 7.

Sara Hathaway, Pittsfield

The writer is a member of the Pittsfield School Committee and a former mayor of Pittsfield.

-----

November 2, 2023

Hello blogger Dan Valenti,

Sara Hathaway's letter endorsing Peter Marchetti for Mayor of Pittsfield is another woman politician who supports a candidate who allegedly called women who worked for him at the Pittsfield Co-op bank: "BITCH". Mayor Linda Tyer and Governor Maura Healey also endorsed Peter Marchetti.

How has Peter Marchetti solved problems in Pittsfield politics? It is Pittsfield's "Level 5" public school district? Is it Pittsfield always being ranked in the top 10 cities by population for violent crime? Is it the 15 empty storefronts on North Street's "Social Services Alley"? Is it "the Ring of Poverty" inner-city distressed neighborhoods that surround North Street? It is the 25-year-old indebted and polluted PEDA debacle that is even worse than Jimmy Ruberto's "Rolodex" tagline? Is it Pittsfield's $205.6 million fiscal year 2024 municipal operating budget in return for "a shit sandwich"? Is it postindustrial Pittsfield's past 50 years of population loss, along with losses of many living wage jobs?

Best wishes,

Jon Melle

-----

.png)