thecahillreport.com

-

-

"I don't seem to be getting anywhere from inside the party, so maybe I can be more effective outside the party. We'll see." -- Treasurer Timothy P. Cahill on 7/7/2009.

-

------

"Boston celebrates St. Patrick's Day" - 2009.

-

-

State Senate President Therese Murray, left, displayed a photograph of Massachusetts Treasurer Timothy Cahill as part of a joke aimed at Governor Deval Patrick, right.

(John Bohn/Boston Globe Staff)

-----

"Lottery winner"

Posted by Dan Wasserman, December 17, 2008, 2:58 P.M.

-

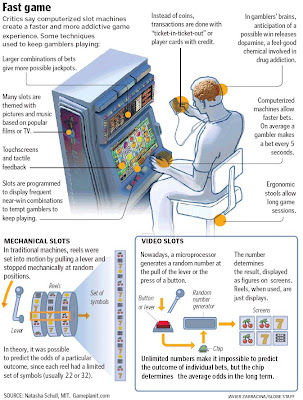

"Cahill's slots"

Posted by Dan Wasserman, March 4, 2009, 5:24 P.M.

-

-

-----

The Heroes Among Us award is a program of the Boston Celtics, presented by the Mass State Lottery represented here by State Treasurer Timothy Cahill.

-----

News Article:

Treasurer issues warning on state finances

The Associated Press

Friday, November 30, 2007, 10:09:48 AM EST

BOSTON (AP) — State Treasurer Timothy Cahill says without some belt-tightening, the state could face a serious fiscal crunch in the coming months.

Cahill issued the warning after the state was forced to borrow $1 billion to make local aid payments to cities and towns.

While borrowing to pay bills is not unusual for the state, the amount was higher than a year ago and followed a report that tax collections were down 2.8 percent in October compared to the same month last year.

Cahill said Governor Deval Patrick and the Legislature should reduce spending and consider budget cuts.

The treasurer and Administration and Finance Secretary Leslie Kirwan planned to send a letter to lawmakers today outlining the state's current financial picture.

-----

Timothy Cahill

-----

News Article

Mass. borrows $1b as tax collections fall

By Andrea Estes, Globe Staff | November 30, 2007

The state is borrowing $1 billion to make its local aid payments to cities and towns at the same time that monthly tax collections have dipped, triggering a warning from state treasurer Timothy Cahill that the Commonwealth could face a severe revenue shortfall in the coming months.

The state routinely borrows to pay its bills, but the amount is significantly higher than last year and Cahill said the borrowing should send a message to the Legislature and the governor that they should curb spending and consider making cuts.

"Borrowing is like paying for groceries with your credit card," he said. "It's not the best way, but if you're expecting a windfall, it's okay. The question is: Are we going to get a windfall?"

Cahill said he's worried that tax collections in October were so weak - down 2.8 percent over October of last year - they could portend a dramatic decline when most people file their income tax returns in April. If the country falls into recession, he said, the state could be in even deeper trouble.

"We're not trending in the right direction. My job is to send out the warning signals. There are storm clouds out there and we have to be very aware," said Cahill, who, along with Administration and Finance Secretary Leslie Kirwan, will send a joint letter to lawmakers today describing the borrowing plan and the state's cash flow situation for the year.

House Speaker Salvatore F. DiMasi, who was briefed on the cash flow report earlier this week, called the borrowing "yet another troubling sign for the Commonwealth's finances in the year ahead.

"One thing is clear from everything we are hearing - we must be conservative in our spending," he said. DiMasi said he has asked Kirwan and the Department of Revenue for more detailed information on the state's fiscal situation and future revenue trends.

Kirwan downplayed the significance of the short-term borrowing, calling it "not in and of itself alarming. It's standard operating procedure," she said, because revenue comes in at a different pace than state spending.

But she said the factors that led to the increased borrowing - like a shortfall in lottery revenues - could mean the state has to use reserves to balance the books at the end of the year. She would not predict how much may have to be taken from the state's rainy day fund.

This year's budget, she said, is based on a projection of 3 percent growth in tax revenues. Collections are up 4 percent for the year, she said. "Clearly, if state tax revenues were to go down over the rest of this year, we'll have even greater financial challenges to deal with."

She said the administration has proposed ways of increasing revenues - including closing corporate tax loopholes - but has been unable to win legislative support.

Michael Widmer, president of the Massachusetts Taxpayers Foundation, one of the state's leading fiscal watchdogs, yesterday predicted the state will have to use $300 million to $700 million in reserves to balance the budget at the end of the year because of increased health and pension costs and declining lottery revenues.

Next year, he said, the shortfall could skyrocket to $1.5 billion because of built-in, escalating expenses.

"All of this is predicated on a slow-growing economy," said Widmer. "But the danger of a national recession increases by the day, which would make this picture even worse. The situation is very serious today, but with a recession it would be dire."

According to Cahill, the state borrowed $200 million in October, $300 million in November, and will borrow another $500 million in December to cover its bills.

The state has never borrowed so much so early in the fiscal year, said Cahill. It is also the maximum amount the state can borrow for the short term by law and is the highest amount since the recession of fiscal 2003, he said. It will cost taxpayers $18 million in interest. Last year, the state borrowed $900 million.

-----

"Fiscal trouble afoot in Boston"

By Hillary Chabot, Eagle Boston Bureau

Saturday, December 01, 2007

BOSTON — Fiscal storm clouds gathered on Beacon Hill yesterday as two state financial officials sent a letter to lawmakers detailing $1 billion in loans needed to make local aid payments to cities and towns.

While the state often borrows money to pay its bills and then pays off the loans when tax money and other funds roll in, Cahill told The Boston Globe yesterday that the $1 billion loan is substantially greater than last year and should send a warning to the Legislature and governor.

"Borrowing is like paying for groceries with your credit card," he told The Globe. "It's not the best way, but if you're expecting a windfall, it's OK. The question is: Are we going to get a windfall?"

A Cahill spokeswoman did not return calls from The Eagle yesterday seeking comment.

The state borrowed a total of $900 million last year to pay for local aid to cities and towns, and the $1 billion loan marks an 11 percent increase.

Reason for concern

Most fiscal watchdogs on Beacon Hill agree that low lottery collections, combined with a dip in tax revenue, mean trouble for next year's budget.

"Overall, is there a concern? Absolutely," said Senate Ways and Means chair Steve Panagiotakos, D-Lowell. "Nationally, never mind statewide, it's possible that by the middle of '08 we're going to be in a recession."

He warned that poor lottery performance combined with an approaching national recession should trigger concern. "It's really not a question of if, but when," Panagiotakos said about a national recession. "I think we all should be proceeding with caution right now. If you look at the financial portents out there, it really is yellow lights everywhere."

Tax revenues above projection

However, Panagiotakos also cast doubt on Cahill's concerns about slow tax revenues. While October tax revenues are 2.8 percent below last year, they are actually above the 3 percent increase projected in the budget.

State Rep. Chris Speranzo, D-Pittsfield, said everyone is aware of the choppy waters ahead. Speranzo serves on the House Ways and Means Committee.

"It sounds as if there is a deficit between the projections in the budget and what they are collecting. Our most important obligation is our cities and towns, however, and we need to keep that commitment."

Michael Widmer, president of the Massachusetts Taxpayers Foundation, said the state may have to use $300 million to $700 million in reserves to balance this year's budget.

-----

State officials detail $1 billion in loans to pay bills

By Hillary Chabot, The North Adams Transcript Statehouse Bureau

Saturday, December 1, 2007

BOSTON — Fiscal storm clouds gathered on Beacon Hill on Friday, as two state financial officials sent a letter to lawmakers detailing $1 billion in loans to pay off bills.

The money will go towards expected state lottery funding to cities and towns.

While Treasurer Tim Cahill pointed to the loan as proof of a bumpy financial year ahead in a published report, the letter — signed by Cahill and Administration and Finance Chief Leslie Kirwan — referred to the loan as expected.

"The projection also reflects a now-typical pattern of tightening in the commonwealth's cash position in the second quarter of the fiscal year," Cahill and Kirwan wrote in the letter.

The state borrowed a total of $900 million last year to pay for local aid to cities and towns, so the $1 billion loan isn't that much of a hike from last year.

A Cahill spokeswoman did not immediately return a call for comment.

Most fiscal watchdogs on Beacon Hill, however, agree that low lottery collections, combined with a dip in tax revenue mean trouble for next year's budget.

"Overall, is there a concern? Absolutely," Senate Ways and Means chair Steve Panagiotakos, D-Lowell, said. "Nationally, never mind statewide, it's possible that by the middle of '08 we're going to be in a recession."

However, Panagiotakos also cast doubt on Cahill's concerns about slow tax revenues. While October tax revenues are 2.8 percent below last year, they are actually above the three percent increase projected in the budget.

"It's really not a question of if, but when," Panagiotakos said about a national recession. "I think we all should be proceeding with caution right now. If you look at the financial portends out there it really is yellow lights everywhere."

Michael Widmer, president of the Massachusetts Taxpayers Founda- tion, said the state may have to use $300 to $700 in reserves to balance this year's budget.

Rep. Chris Speranzo, D-Pittsfield, said everyone is aware of the choppy waters ahead. Speranzo serves on the House Ways and Means Committee.

"It sounds as if there is a deficit between the projections in the budget and what they are collecting. Our most important obligtation is our cities and towns, however, and we need to keep that commitment."

-----

-----

News Article:

"Volatile holdings part of state fund: SIVs add risk as communities seek to increase income"

By Ross Kerber, (Boston) Globe Staff | December 5, 2007

A state fund Massachusetts cities and towns use to temporarily invest their cash holds roughly $134 million in volatile "structured investment vehicles" - including four that face possible downgrades.

Yesterday, state Treasurer Timothy Cahill said he does not expect municipalities to suffer losses on their investments in the Massachusetts Municipal Depository Trust.

SIVs represent just a fraction of the fund's total assets of $5.6 billion, he noted.

In Florida yesterday, officials approved a bailout plan for that state's $14 billion investment pool, turning its management over to BlackRock Inc. and accepting the resignation of the fund's executive director.

Florida officials froze withdrawals from the pool last month after municipalities that invested in it grew wary of its holdings in a defaulted SIV and withdrew almost half of its $27 billion in assets.

SIVs also appear in Connecticut's cash portfolio and may lead to tens of millions of dollars in losses, an official there said yesterday.

These state investment pools resemble money-market funds for individual investors.

Mostly, they invest in US Treasury bills and other short-term securities that allow them to pay a slightly higher rate of interest.

But to increase their returns, many also invest a portion of their funds in "commercial paper," such as mortgage loans packaged into SIVs, or corporate debt backed by assets like real estate.

Cahill said the SIVs held by the Massachusetts trust have not defaulted, unlike those held by other states.

He also said no local government has objected to the trust's investments or sought to withdraw its money.

"The difference between us, Florida, and Connecticut is that we haven't been reaching for yield," he said. "We haven't taken added risk to get returns."

SIVs have also caused concern for retail money market funds that hold many of their securities, and companies like Wachovia Corp. have put up cash to make up for losses. Major investors, including Fidelity Investments and Bank of America Corp., are attempting to organize an $80 billion bailout fund to allow the SIVs to continue to operate.

Fidelity also manages the Massachusetts Municipal Depository Trust, an investment pool meant as a place for the state and municipal entities to earn interest on cash from tax collections and other revenue until they need it to pay their bills. The fund's returns have averaged about 5 percent a year recently.

This year, Fidelity has taken positions in six SIVs, Cahill said: Beta Finance Corp., Centauri Corp., Cullinan Finance, Dorada Corp., Links Finance, and Sigma.

On Friday, the rating agency Moody's Investors Service said it had placed four of them on review for possible downgrades. (Cahill said they hold only about $50 million of state assets.)

The investment vehicles, mostly operated by large financial companies such as Citigroup Inc., have come under close scrutiny lately.

Local officials in Reading and Concord have questioned Fidelity's holdings in SIVs. Concord's finance director, Anthony Logalbo, has about $25 million of the town's $100 million operating budget in the state fund on an average day.

Logalbo said he's not worried about that, partly because Fidelity has told him it has senior securities in the SIVs that would give its investments preference over other creditors holding subordinated debt in case of a default. "I'm satisfied that they're carrying out their fiduciary responsibilities," he said.

A Fidelity spokesman said he could not discuss Massachusetts as a client, but said:

"We believe the investments we have made on behalf of clients in SIV-related debt securities continue to represent minimal credit risk. We have a rigorous research process to approve debt securities for purchase in our money market portfolios, and we have been selective in this approval process."

In Connecticut, a similar cash fund, known as the State Short-Term Investment Fund, held about $400 million of its total assets of $5 billion in some of the same SIV. About $100 million was invested in an SIV known as Cheyne Finance, that has defaulted, forcing creditors into a restructuring process to recover money.

The state is likely to have to take losses as a result, said Larry Wilson, assistant treasurer, but the losses would be covered by a $52 million reserve. He said several towns withdrew money from the pool, but none of the pool's largest participants, including the state of Connecticut, have withdrawn cash.

-

Ross Kerber can be reached at kerber@globe.com. Bloomberg News contributed to this report.

-----

"Mass. tax group sees big healthcare hit to employers"

December 7, 2007

Employers will spend an estimated $175 million more a year for health insurance under the state's healthcare reform law, according to a report released yesterday by the Massachusetts Taxpayers Foundation.

The increase in costs will include $150 million as more employees accept coverage and $24 million for new prescription drug benefits, according to the report, "An Analysis of the Essential Role of Employers in Massachusetts Health Care Reform."

The report also estimates that about 50,000 employees and their dependents will take advantage of their employer health plans because the new law requires everyone to have health insurance.

Michael J. Widmer, president of the business-backed budget watchdog group, said the study marks the first time someone has tried to estimate the costs of the new law to businesses.

"Employers are carrying a major responsibility in terms of healthcare reform," he said.

The report concluded with a warning that rising healthcare costs must be controlled or the new system could be jeopardized.

"The delicate balance of shared responsibility among government, employers, and individuals - and the broad consensus of support for healthcare reform in Massachusetts - assumes that health coverage will not become unaffordable for any of the parties, an assumption that will be constantly tested as more and more residents become insured," the report said.

MARTIN FINUCANE

-----

"Experts warn of fiscal fiasco"

By Matt Murphy, Eagle Boston Bureau

Friday, December 07, 2007

BOSTON — It's becoming a story all too familiar for Massachusetts cities and towns.

Rising health care and special-education costs, slow growth in new industries and a need to invest in public infrastructure have left communities strapped for cash and turning to residents for help.

The so-called "municipal meltdown," a moniker coined by the Boston public policy think tank MassInc., is a real threat to cities and towns hoping to avoid drastic reductions in services in years to come, according to experts.

But the solution is anything but clear.

"We have to figure out who the real villains are, and it's not us," said Sen. Steven Tolman, D-Brighton, referring to the state legislators, municipal leaders and unions. "We have to work together."

Tolman participated in a forum sponsored by MassInc. in Boston yesterday to discuss issues facing cities and towns raised by the cover story in the fall issue of CommonWealth Magazine, published by MassInc. Geoff Beckwith, executive director of the Massachusetts Municipal Association, Barbara Anderson, head of the Citizens for Limited Taxation, Amesbury Mayor Thatcher Kezer and Massachusetts Teachers' Association President Paul Toner also took part in the discussion.

Anderson, a fierce critic of wasteful government spending, said that Bay State residents no longer trust local government officials when they say their towns are in dire fiscal straits.

That lack of trust has built up over the years, said Anderson, pointing to the Legislature's refusal to reduce the state income tax, despite voters approving the reduction on a ballot question.

She also did not hesitate in blaming unions for soaking cities and towns, arguing that the state could send a strong message with a symbolic move to curtail police details on road projects that also would save cities and towns money.

"Until we take on the unions, we aren't going to be able to save ourselves from this fiscal meltdown," Anderson said.

Beckwith and Thatcher downplayed Anderson's spirited argument about wasteful spending, calling for a more generous pact between state and municipal government on local aid and a focus on new sources of revenue.

Local aid, when adjusted for inflation, has been reduced $621 million since 2002, according to Beckwith, while new revenue also has been slow to grow.

Beckwith said that cities and towns must be given more control from the state to control their own finances.

"We need to empower communities to do this," Beckwith said, of digging themselves out from under heavy financial pressures.

-----

"Usual state money woes"

The Berkshire Eagle - Editorial

Article Last Updated: 12/08/2007

Monday, December 10, 2007

Massachusetts communities are used to warnings about cutbacks in aid from the state, but while the red flags being flown now aren't surprising they are a source of frustration. Rising health care costs are part of the problem, and absent major reform along the lines of a government-backed single-payer program, that problem will only grow worse. Special education costs are climbing too, and the stricter guidelines needed to lower those costs aren't on the horizon either. While it is easy to scapegoat unions, as does Barbara Anderson, the head of Citizens for Limited Taxation, unions representing city and town employees will have to make the kinds of health coverage and pension concessions that are now routine in the private sector. We agree with Ms. Anderson that Beacon Hill should take on the police unions insisting that officers be present at road projects. That money wasted could better benefit struggling communities.

SBRSD as state ward

When it rubber-stamped Sheffield's decision to change the formula for assessing its residents for school costs, the state Department of Education knew it might end up running a school district for the first time if there was no resolution of the dispute between Sheffield and the four other communities that make up the Southern Berkshire Regional School District. There was none, and the DOE is now in charge, though DOE officials appear unclear on what that entails. Unless it wants to be responsible for the SBRSD indefinitely, the state agency needs to abandon its passive approach and push for a resolution of the dispute.

----------

"Cahill Suggests Legalizing Gambling"

By Martha Bebinger, WBUR Newsroom

BOSTON - May 25, 2007 - TEXT OF STORY (In Part):

MARTHA BEBINGER: Treasurer Cahill says Massachusetts has to find a new source of revenue. Lottery sales are down and the state is losing jobs while spending commitments for the new health care law and biotech research are growing. Cahill says he doesn't want to just sit back and watch the Mashpee Wampanoag push for a casino.

...BEBINGER: ...House Speaker Sal DiMasi says on balance, Cahill's plan may not make sense.

...BEBINGER: DiMasi says he believes that the majority of house members remain opposed to casino gambling. DiMasi's point person on gambling, Representative Dan Bosley says that's one reason why a casino is not a "fais de complet" for Massachusetts.

BOSLEY: We fall in the trap of saying this is an inevitability, so let's get in front of it and make the best deal we possibly can, but I don't believe it's an inevitability. If people look at this, they'll understand that while some people from Massachusetts do go to Connecticut to game, most of the gamblers that would come to a new casino would be from Massachusetts, and we wouldn't make as much money as people think we would on casinos.

...BEBINGER: While much of the attention about a tribal casino has been focused on the Mashpees, a related but separate tribe, the Wampanoag's of Gay Head Aquinnah, also plans to renew a casino bid.

Both tribes have considered the possibility that they could open casinos now, based on a state law that allows nonprofit groups to run so-called "Las Vegas Nights." Gary Garrison, a spokesman for the federal Office of Indian Affairs says similar laws have been the basis for casinos in other states.

...The legislature, hearings on gambling bills, and possibly Cahill's plan, are scheduled for mid June.

http://www.wbur.org/news/2007/67443_20070525.asp

--------------

EDITORIAL - (North Adams, Massachusetts) TheTranscript.com

"Don't bet on it"

Saturday, May 26, 2007

Now comes our illustrious state treasurer, Tim Cahill, with a proposal for the state to roll the dice and build a casino somewhere in Massachusetts before the Wampanoags do. It's a foolish proposition and one likely to shoot snake eyes with the Legislature upon arrival, thank goodness.

Some in Berkshire County are slavering over the idea, though, in Web blogs or in grocery-market conversations, feeling it would somehow be a panacea to employment woes around hereabouts — or perhaps a closer gambling mecca where they could feed their habit. Somehow they are under the delusion that state leaders would actually consider the idea of building a casino in the Berkshires, if indeed they pursue the idea at all.

Right. It would be way up there on the list of projects we are likely to see in our lifetimes, directly after the Pittsfield bypass and the tramway to Mount Greylock. We do bear in mind, of course, that Adams voters wholeheartedly backed the idea of a casino on Greylock a few years back — and we know what sway Adams has in Boston.

State Rep. Daniel Bosley, our stalwart North Adams Democrat, is already staunchly against the idea of the casino, rightly pointing out that the Wampanoags will build one soon anyway — perhaps in 2010, and the state would have a hard time competing — or, more importantly, getting any revenue at all from the tribe for the privilege of its building in Massachusetts.

Gov. Deval Patrick should tell Mr. Cahill to devote his energy to coming up with ways to shore up sagging state lottery revenues instead of playing long shots. The proper place for a casino in Massachusetts, if we must have one, is on Cape Cod, where tourists have already spoiled a once fabled vacation spot.

----------

"Larger state deficit predicted due to near-static tax revenue"

By Andrea Estes, (Boston) Globe Staff | December 14, 2007

State officials and fiscal analysts yesterday predicted relatively small increases of 2.4 percent to 4.1 percent in state tax collections next year, saying the rise will not be enough to close a projected budget gap for the 2009 fiscal year that could top $1 billion.

"What this says for the fiscal '09 budget is that the Commonwealth is in deep trouble," said Michael Widmer, president of the Massachusetts Taxpayers Foundation, who is warning the shortfall could balloon to $1.5 billion because of spending increases that are built into the budget.

The slowing economy, stagnant corporate profits, and declining capital gains are sparking the state revenue dip, said several who testified at a State House hearing yesterday.

In addition, though poised to post its highest revenues ever, the state lottery will not be able to meet overly optimistic expectations built into the budget or continue to grow in the future, said State Treasurer Timothy Cahill. The lottery provides about $900 million to cities and towns, which have come to expect annual increases, said Cahill.

The officials and fiscal analysts appeared before a joint hearing of the Senate and House Committees on Ways and Means, who are working to come up with a revenue estimate that will guide Governor Deval Patrick and lawmakers as they put together next year's budget. Patrick is expected to unveil his budget plan on Jan. 23.

All the fiscal analysts predicted revenues would grow modestly in the next fiscal year, which begins July 1. In a budget of more than $20 billion, the differences among estimates were relatively minor.

Widmer had the most pessimistic projection - 2.4 percent growth from fiscal year 2008 to 2009 - while the Beacon Hill Institute, a conservative think tank, offered the most optimistic estimate, 4.1 percent.

The predictions of lower revenue led lawmakers to raise questions about potential new revenue generators, such as casinos, and the governor's proposal to close corporate loopholes.

Cahill predicted casinos could "produce a tremendous amount of revenue" for the state based on the spending habits of Massachusetts residents who, he said, spend far more on the lottery per capita than residents of any other state.

"I think they will be very, very successful," he said.

He acknowledged that introduction of casinos would hurt the lottery in the short term, siphoning off between 3 to 8 percent a year. But ultimately, he predicted, lottery players would return.

Cahill was asked whether the state should now sell the lottery to private investors to reap a huge windfall, a proposal recently floated by some Republican lawmakers. Cahill said interest has evaporated since last summer, when several investment firms were offering billions of dollars to buy or lease the lottery.

He suggested that the state instead look for ways to undo the built-in deficit that has been created by state employee health insurance and pension costs that are growing faster than revenues.

"We cannot pay for them indefinitely," he said. "It's not possible. We do not have the structure in place to support these programs at the level we desire."

Jonathan Haughton of the Beacon Hill Institute suggested the state raise the 23.5-cent-per-gallon gas tax and impose more fees on highway and bridge users, suggestions also made by a recent legislative Transportation Finance Commission.

Meanwhile, voters next fall could be asked to eliminate the most basic source of state revenue, the income tax.

Secretary of State William F. Galvin yesterday ruled that proponents of a ballot question that would repeal the state income tax had collected more than the 66,593 signatures required to send the petition to the Legislature. If lawmakers fail to vote on the matter before May 6, proponents can put the question on the Nov. 4 ballot by collecting 11,099 more signatures by July 3.

When it last appeared on the ballot in 2002, the measure was defeated, but received more than 45 percent of the vote.

----------

"Businesses to state: We pay fair share"

By Hillary Chabot, Eagle Boston Bureau

Tuesday, December 18, 2007

BOSTON — As fiscal watchdogs predict a lifeless 2.4 percent revenue growth next fiscal year, a pro-business group has told legislators to look elsewhere for additional cash.

Businesses have seen their state and local taxes hiked 45 percent in the past five years, according to a report released by the Associated Industries of Massachusetts. The report yesterday came before Beacon Hill policymakers vote today on a move to close corporate tax loopholes.

"The report ... should clear up any questions as to whether business is paying its fair share," said Richard Lord, president of AIM.

State officials and fiscal analysts predict a small revenue growth of 2.4 to 4.1 percent in state tax collections next year. The growth will not be enough to close a $1.5 billion budget deficit predicted by Gov. Deval L. Patrick's finance chief, Leslie Kirwan.

The state lottery, which is a main source of funding for cities and towns, also will not be able to meet projections in the current budget and is expected to continue sluggish growth.

"I think fiscal year '09 is going to be much more difficult than '08 in terms of balancing the budget, and the lottery just compounds it," said Michael Widmer, president of the Massachusetts Taxpayers Foundation.

Although Beacon Hill Institute proposed hiking the 23.5-cent-per-gallon gas tax or imposing more fees on highway users, alternatives such as closing tax loopholes for corporations and building casinos are under serious consideration by legislators.

Alan Clayton-Matthews, an economics professor at the University of Massachusetts Boston and a member of the panel of 15 examining the loopholes, supports closing them. The state could rake in $200 million by closing the combined reporting loophole, which would treat a parent corporation and its subsidiaries as a single entity, and the state would tax a portion of the combined national income.

Currently, businesses can open a subsidiary in a low- or no-tax state and transfer their assets there to avoid paying taxes. The combined reporting could bring in $200 million for the state.

Widmer said he is open to closing the loopholes but believes that the businesses cannot take additional taxes. He suggests cutting the tax rate for businesses.

"We're among the most costly states in the nation (to operate). It's a situation where many businesses are not able to compete, and that's costing us jobs," Widmer said.

The panel, made up of legislators and economic analysts, is set to report on whether legislators should close the loopholes today.

----------

"City would get $2.56M from proposed aid bill"

By Hillary Chabot, Transcript Statehouse Bureau

Thursday, January 3, 2008

BOSTON — Cities and towns would be in line to collect $450 million under a bill filed by House Minority Leader Brad Jones, R-North Reading.

The bill would take $450 million from the state s $2.3 billion rainy day fund and give it to communities to make up for the state lottery aid, which was capped for several years.

"We took money from cities and towns that we didn't need to take, and we should give it back," Jones said.

The bill would bring $454,000 to Great Barrington, $284,000 to Lenox, $4.74 million to Pittsfield, and $2.56 million to North Adams.

Michael Widmer, executive director of Massachusetts taxpayers association, believes an upcoming recession means the state might have to lean heavily on reserves.

"This would require taking money from the rainy day fund, but we're going to need those funds to weather the next recession which could be right around the corner," Widmer said.

Jones sent a letter encouraging local officials to contact House Speaker Salvatore DiMasi about the bill, but few officials have called the office, said DiMasi spokesman David Guarino.

House Ways and Means Chairman Robert DeLeo, D-Winthrop, argued against depleting the state's rainy day account to give one time cash to cities and towns.

"What happens next year? The answer: We either have to take another $450 million from the rainy day fund or hang cities and towns out to dry," DeLeo wrote in a letter sent to newspapers across the state.

DeLeo went on to criticize the minority party for "a political gimmick."

"Don't be fooled. When it comes to the 351 cities and towns across the commonwealth, we need to provide real help, not gimmicks," DeLeo wrote.

Jones attempted to send $450 million back to communities earlier this year as an amendment to a supplemental budget. The amendment was soundly defeated.

Rep. Robert Hargraves, R-Groton, thinks the refund is only fair.

"This isn't rocket science," Hargraves said. "We put towns in unfortunate straights and we didn't have to."

--

"Eyeing rainy day fund"

The Berkshire Eagle - Editorial

Friday, January 04, 2008

A proposal to take $450 million from the state's "rainy day" fund to make up for lost lottery revenue is the kind of feel-good proposal that has gotten Massachusetts into economic problems in the past. It does, however, serve the purpose of drawing attention to the unreliability of gambling money as the state considers establishing three casinos.

House Minority Leader Brad Jones Jr. proposes taking the money from the $2.2 billion fund and distributing it to the state's communities to make up for lottery aid capped in 2003-05 to address a budget gap. Lottery revenue has been declining in recent years in spite of the introduction of new games, jeopardizing a revenue source for educational and social programs. House Minority Leader Robert DeLeo, a Winthrop Democrat, makes the obvious point that if the money is used once it will undoubtedly be used again as communities will face the same budget problems a year from now. Early indications are that few community officials have answered Mr. Jones' call to lobby legislators to dip into the rainy day fund, and what Mr. DeLeo describes as a "political gimmick" is unlikely to become law.

The rainy day fund should be used for financial emergencies, such as a major recession. Massachusetts isn't in a recession now, though if the United States slips into one, the Bay State is often the canary in the coal mine. Lost lottery revenue, however, does not constitute an emergency. It is a fact of life legislators and cities and towns must adjust to.

Lottery games prey on low-income residents, and while it isn't known if those buyers are kicking the habit or are now too poor to buy tickets, there is no denying that lottery revenue is declining. This comes as Governor Patrick is beginning a newly aggressive push to introduce three casinos into the state to bring in new revenue. The administration apparently assumes that these casinos will draw revenue equivalent to Connecticut's two giant casinos, but there is a limit somewhere to gambling dollars, and five casinos in the same region may find it. Should neighbors Rhode Island, New York, New Hampshire and Maine succumb to casino mania (only stalwart Vermont is keeping its head so far), the casinos will cannibalize one another, and join the lotteries as a revenue-generating disappointment.

Governor Patrick is thought to be considering the inclusion of the $800 million in licensing fees to be paid by casino developers in his next budget to pressure the Legislature to act on his bill, but such a political stunt may doom his proposal to oblivion. Mr. Patrick should consult his last four predecessors about their fortunes in picking fights with lawmakers.

Should legislators reject casinos, as we believe they should, they are obligated to consider needed alternative revenue sources. There is money to be made by closing corporate tax loopholes and merging the Highway Department with the Turnpike Authority. Beacon Hill's refusal to confront the state police union about its construction job perk is infuriating. Hiring lower-paid flagmen to monitor construction sites would alone account for most or all of the money Mr. Jones wants to remove from the rainy day fund.

----------

"New mayors, old problems"

By Keith O'Brien, (Boston) Globe Staff, January 3, 2008

Nearly a dozen new mayors and 27 incumbents are being sworn into municipal office this week with all the usual pomp and pageantry: parties and speeches, glad-handing and back-slapping, and, in some communities, inaugural balls.

But for most, the party will be short-lived.

Across the Commonwealth, cities and towns are considering laying off staff, cutting services, and preparing to make cuts to school sports programs as they struggle to close multimillion-dollar budget deficits in the coming fiscal year. Some municipalities are once again considering property tax overrides, even though voters in a majority of towns have rejected tax increases over the last two years.

And it could get worse, officials say, if a state budget deficit projected at more than $1 billion in fiscal 2009 gives communities even fewer dollars to pay for the services that people have come to expect.

"The writing on the wall, to me, is that we shouldn't be looking to the state for any additional aid, so it's a little sobering," said Tom Koch, who will be sworn in as Quincy's mayor next Monday. "It's a challenge to run local government without hitting the citizenry for increases in taxes, and that's always going to be a challenge, whether it's Quincy or Weymouth or Boston or wherever you go."

In Chelmsford, town officials may be forced to send firefighters and police officers packing. In the Lincoln-Sudbury regional school district, officials are threatening cuts in staff and in underclass sports. And in Gloucester, officials are staring at a projected $2.5 million shortfall in a budget of roughly $90 million.

"So what are you going to do?" asked City Council President Bruce Tobey of Gloucester. "You have to cut."

At a time when cash-strapped communities have become the norm, this year's financial outlook appears especially troubled. Since 2002, according to the Massachusetts Municipal Association, local aid from the state's major accounts is down $621 million annually. Attempts by communities to generate more revenue through Proposition 2 1/2 property tax overrides have more often than not failed to gain voter support. In the last two years, 138 communities have asked voters to approve property tax overrides and 71 of those efforts have failed.

These fiscal circumstances have left many communities squeezed, said Geoff Beckwith, executive director of the Municipal Association.

On the one hand, he said, communities have maximized their reliance on property taxes or exhausted voters' tolerance for more property tax overrides. And on the other hand, Beckwith said, the price of so-called fixed costs, such as fuel and road salt, keeps rising.

As a result, cities and towns across the Commonwealth have been forced in the last year to cut staff, trim library hours, and slash services once thought of as essential, such as school buses. Beckwith predicts that even more communities will be forced to make cuts this year, leaving newly inaugurated mayors with a tough job ahead of them.

"There are dozens of people raising their hands and taking the oath of office this week to step into the mayor's office for the first time or return to office," Beckwith said. "The common problem they all share is when they look out the front window of City Hall, they're looking at a pretty bleak fiscal landscape."

In Saugus, town officials had to cut $5 million in services last year to come in under budget. Though Andrew R. Bisignani, the Saugus town manager, said he expects to recover somewhat in fiscal 2009, problems remain.

Already, Bisignani said, the town has spent roughly $100,000 more than it budgeted for snow and ice removal.

"I'm nervous," he said about the year ahead. "There's just so much uncertainty."

In Chelmsford, a projected $3.3 million shortfall in the roughly $100 million budget for fiscal 2009 may force the town to lay off police officers and firefighters.

Town Manager Paul Cohen said that the town does not want to cut staff, but that soaring costs leave officials no choice unless voters approve a property tax increase this year.

"We're very concerned," Cohen said. "We will address the shortfall. But unfortunately, addressing the shortfall will affect education and public safety."

In Gloucester, still more cuts are looming. Mayor Carolyn Kirk, who was sworn in this week, projects a $2.5 million shortfall for the city's upcoming budget, and she announced a hiring freeze in her inaugural address.

"I call it an austerity program," Kirk said. "The hiring freeze is part of that. But, also, I will be reviewing every expenditure over $100."

By saving pennies, Kirk said, she hopes the dollars will follow.

But Kirk and other mayors also say the state needs to do its part. Mayor Joseph Curtatone of Somerville, president of the Massachusetts Mayors' Association, wants the Legislature to approve several pieces of Governor Deval Patrick's Municipal Partnership Act.

That measure, among other things, would eliminate local tax breaks to phone companies and give cities and towns the right to levy meals taxes.

For Somerville, Curtatone said, those changes would generate an additional $1.8 million a year for its approximately $155 million budget.

But just as important as the money, said Mayor Thomas M. Menino of Boston, would be the stability that would come with the revenue. "We're not looking for a windfall," he said. "We just want to be able to determine our own destiny."

The Legislature has not budgeted based on Patrick's proposal. But Lieutenant Governor Timothy P. Murray said the administration plans to continue pushing for the changes this year.

Eliminating tax breaks to the phone companies alone would generate $78 million in revenue for communities, Murray said.

There is at least one other possible source of revenue in fiscal year 2009: money raised by the sale of casino licenses.

"That's on the table," said Murray, who would not say whether the administration would include casino revenue in its upcoming budget. "We haven't made a final decision," he said. "But we aren't ruling it out."

In the meantime, mayors will continue looking for ways to pay the bills. In Braintree, that process begins this morning, said Mayor Joseph Sullivan, who was sworn in last night as the town's first mayor. His first meeting, he said, will be with the town's finance team.

"There's not going to be any time to settle in," Sullivan said. "My agenda's already booked for the next several weeks."

-

Keith O'Brien can be reached at kobrien@globe.com.

----------

A Boston GLOBE EDITORIAL

"A crisis in cities and towns"

January 11, 2008

AS DISCUSSION topics go, municipal finance doesn't light up the room. But anyone who has called 911, driven on a town road, enrolled a child in school, or paid a property tax bill can't afford to ignore the growing fiscal crisis faced by local communities.

Mayors, selectmen, and other municipal officials speak of little else. Today, they will have the ear of Governor Patrick at the opening of the annual meeting of the Massachusetts Municipal Association. Despite distinctions of degree, nearly every city and town in the Commonwealth is struggling to provide reliable basic services to residents at a time when the costs of government outstrip the ability to raise revenues.

The MMA's weekend workshops will be a respite for some officials who must return home and face decisions about laying off teachers, closing fire stations, reducing library hours or raising fees to play high school sports. Many of these officials have fought losing battles to override Proposition 2 1/2, the state law that limits the amount of revenue a city or town may raise from property taxes. Most can't plan properly from fiscal year to fiscal year when dealing with so many uncertainties, including state lottery receipts, a key source of local aid.

Even when they are running at their leanest, most cities and towns rely too heavily on property taxes to meet rising costs of necessities ranging from road salt to employee healthcare. So Geoffrey Beckwith, director of MMA, is pushing hard for a revenue-sharing plan that would earmark 40 percent of the state's main revenue sources - sales, income, and corporate excise taxes - to cities and towns. This year, such a formula would add roughly $790 million to the state's $6.4 billion distribution of education and municipal aid. But a fixed formula isn't likely to go over well with Beacon Hill leaders who value their own budget flexibility.

If legislators can't guarantee a fixed percentage for local aid, they should at least give cities and towns a fighting chance. For years, the MMA and its members have been seeking state approval to raise their own revenues, through local option taxes on meals and other sensible proposals. But some governor or legislative leader always goes weak in the knees. Last year, Patrick raised hopes with his plan to eliminate property tax loopholes for telephone and telecommunication companies. But he couldn't sell it to the Legislature. A bill did pass allowing local workers to join the efficient group health plan offered to state employees. But it requires union approval. That's an anemic solution. Cities and towns need the same tools the state employs to control healthcare costs without negotiating every co-pay increase at the collective bargaining table.

Beacon Hill needs to listen. This isn't mere sniveling on the part of town criers.

----------

"Patrick touts municipal relief proposals at gathering of local officials"

January 11, 2008, 11:01 AM

By Matt Viser, (Boston) Globe Staff

He feels their pain. Governor Deval Patrick told city and town officials today that he understands that they're experiencing tight fiscal times. And he offered a solution: his municipal relief legislation.

Speaking at the annual meeting of the Massachusetts Municipal Association, which represents the state's 351 cities and towns, he offered some of his harshest criticism yet of the Legislature as he urged local officials to lobby their state representatives to act on his bill.

"So far not one of the revenue options has been heard for a vote in the Legislature. Not one!" he said, shouting into the microphone. "That is not acceptable. It ought not be acceptable to you, and you have to show up and make that point!"

Patrick's Municipal Partnership Act includes proposals that would allow communities to raise more revenues through, among other things, meals taxes and telecommunications taxes.

Patrick also took a swipe at the administration of former Governor Mitt Romney, who trimmed state aid to cities and towns in order to close a state budget gap.

"Our budget will not be balanced on your backs," he told the crowd gathered at the Hynes Convention Center in Boston. "The strategy of the previous administration of shifting state fiscal hardships to cities and towns is no solution. That time is over, it's over. And it's not coming back."

A report issued yesterday by a state budget watchdog group found that city and town governments, who have slashed programs and services or raised taxes in recent years because of tight finances, are likely to face even greater challenges over the next several years.

"The finances are being relentlessly squeezed year by year," said Michael Widmer, president of the business-backed Massachusetts Taxpayers Foundation.

Patrick also defended his proposal to license three resort casinos in Massachusetts, saying it would help revitalize the state economy by supporting a new industry.

He reiterated his arguments that expanded gambling would not change the character of the state; that Massachusetts residents spend $900 million to $1.1 billion at Connecticut casinos; and that "for well over 90 percent it is harmless entertainment."

----------

"Report: Gloomy local budgets ahead"

By Hillary Chabot, Transcript Statehouse Bureau

Monday, January 21, 2008

BOSTON — There is a fiscal storm brewing, and state officials are hoarding the umbrellas.

A report recently released by Beacon Hill financial watchdog the Massachusetts Taxpayers Foundation details a gloomy budget season ahead for cities and towns in the Bay State and asks state lawmakers to give municipalities more tools to boost their budgets.

"The overall picture is that costs are growing more quickly than revenues, and with limited increases in state aid, cities and towns are being squeezed, Michael J. Widmer, president of the taxpayers foundation, said. "Without a more dependable revenue stream and decisive action to address health care costs, there will be an acceleration of the cuts in programs and services that have already impacted a large number of communities."

Skyrocketing health insurance costs, combined with a growing aversion towards Proposition 2 1/2 overrides, means municipalities are already facing shrinking budgets.

"We've not only had to raise more property taxes, we've also depleted our reserves while the state's have grown by $600 million," said North Adams Mayor John Barrett III.

Many cities and towns, showing slow new growth, have raised their property taxes to the limit without triggering an override.

"The property tax is the worst form of taxation. It's the most regressive, and it's difficult for people to absorb," said Lowell City Manager Bernie Lynch.

And there is little appetite for overrides. A total of 81 overrides were passed in the Bay State in 2004, bringing in $39 million, but only 53 were passed in 2007, allowing cities and towns to pick up $37 million.

"People are fed up with rising property taxes," said Rep. Jamie Eldridge, D-Acton.

The dwindling sales of the state lottery means municipalities are facing an even larger squeeze, Widmer said. While local aid was boosted by 8.1 percent in 2007, lottery sales are slowing. The Legislature appropriated $920 million in lottery funds for municipalities in 2007, but the lottery was only able to give out $802 million.

The larger issue is whether the state is going to try to identify any kind of new revenue source for cities and towns, Widmer said.

"That's the overarching question no one wants to discuss, because they can't provide money to city and towns within current arrangements," he said.

Gov. Deval Patrick said he plans on using casino revenue and closing the corporate tax loopholes in his budget, scheduled to be released on Jan. 23, but Widmer said those aren't enough.

Many municipal leaders point to Patrick's Municipal Partnership Act, which allowed cities and towns to decide whether they want to increase the meals tax or move municipal employees to the Group Insurance Commission. But many of those initiatives, except for the insurance commission, have stalled in the Legislature.

"There have to be those tools put out there in terms of new revenues and in terms of controlling costs," Lynch said. "At the end of day, we need to recognize the realities of reduced services or more taxes."

----------

"State leaders debate using rainy day fund"

By Matt Murphy, Berkshire Eagle Boston Bureau

Saturday, January 26, 2008

BOSTON — As the state and national economy slides toward recession, Massachusetts political leaders face the difficult decision of deciding if and when to dip into the state's hefty store of reserves.

Gov. Deval L. Patrick this week proposed a $28.2 billion budget that does just that, relying on $369 million from the state's rainy day fund to balance a budget that includes a number of other one-time revenue sources.

This move has prompted criticism from some fiscal conservatives and budget watchers who suggest it might be too early to draw from the well while state revenues continue to grow, albeit at a much slower rate than in years past.

"It's one-time money, a one-time thing when we're projecting state revenues to continue to grow. Obviously, if we hit an economic downturn, if indeed it is raining, then we can talk about the rainy day fund," said Steve Poftak, research director at the Pioneer Institute, a Boston-based think tank.

Since 2004, the state has steadily built up its rainy day fund from $641 million to the third-largest reserve fund of any state in the nation, trailing only California and Alaska with $2.36 billion in the bank.

The budget also includes more than $400 million in revenues from casino-licensing fees and closing business loopholes. Those two initiatives face an uncertain passage by the Legislature.

Patrick's budget proposal calls for modest 3.5 percent increase in spending. Only four-tenths of that spending is on new programs and initiatives. The rest comes from increased health insurance costs, debt obligations, salaries and other fixed expenses, according to the administration.

"If we didn't propose any of those new revenue sources, we would be left with the only option of pulling more from stabilization," said Cyndi Roy, a spokeswoman for Patrick.

The challenge, therefore, falls to the Legislature. Without new casino or corporate tax revenue, House and Senate leaders will likely have to choose between new taxes, deep cuts in spending, or and even bigger draw from the rainy day fund.

"I assume we will have to use more stabilization money than the governor has proposed," conceded state Rep. Daniel E. Bosley, a North Adams Democrat and leading opponent of Patrick's casino gambling plan.

----------

"Mass. treasurer pushes $600M plan to repair decaying bridges"

By Ken Maguire, Associated Press Writer, January 29, 2008

BOSTON --Lawmakers gave tepid support Tuesday to state Treasurer Tim Cahill's proposal to recycle a financial model used for the Big Dig in the late-1990s to come up with the $600 million needed to repair 10 of the state's most damaged bridges.

Cahill's proposal, announced Tuesday, comes a week after the Patrick administration said it would not include any revenue-generating ideas -- increasing the gas tax, for example -- in its yet-to-be-filed transportation reform legislation.

The treasurer's plan involves immediate borrowing against future federal transportation funding commitments to Massachusetts. He says hundreds of millions of dollars would be saved by locking in today's construction costs.

"What we're trying to do is avoid a future Minnesota incident, where you have a major bridge that goes over a body of water that breaks down, and that causes loss of lives and significant loss of business," Cahill told an audience of business executives Tuesday morning.

Last Aug. 1, the Interstate 35W bridge plummeted 60 feet into the Mississippi River in Minneapolis, killing 13 people and injuring 145.

The 10 bridges were identified as structurally unsound in a recent report by a transportation finance commission, which also said the state faces a $15 billion deficit in transportation infrastructure maintenance over the next 20 years. Without a source of funding, it could take up to 10 years to fix the bridges, Cahill said.

Cahill's plan would need approval from the Legislature and the federal government.

"This is an interesting and unique proposal from the treasurer and one we had already been considering," said David Guarino, spokesman for House Speaker Salvatore DiMasi, pledging it would receive "a full analysis in the House."

A spokesman for Senate President Therese Murray said she hasn't had time to review the proposal. Sen. Steve Baddour, co-chairman of the Transportation Committee, did not return a call.

Gov. Deval Patrick, whom Cahill said wasn't briefed before the announcement in a breach of Statehouse protocol, said he's open to looking at any suggestions, including Cahill's, to help bring in the money needed to repair the state's crumbling transportation infrastructure.

"It's not a new idea and we are certainly interested in working with the treasurer," Patrick said.

Rep. Joseph Wagner, a Chicopee Democrat who is Baddour's co-chair, said there are downsides to Cahill's plan. Because of a 20 percent match of state dollars to federal dollars, there would be less state money available to pay for other projects.

Wagner cautioned that Cahill shouldn't identify specific projects because lawmakers not affected by the plan would have less incentive to support it.

"Generally speaking it is an idea worth exploring," he said. "The details are better left to the Legislature and the executive branch."

Last week, Transportation Secretary Bernard Cohen told the legislative committee that the administration's bill to create a single, massive transportation agency -- dubbed MassTrans -- won't be filed until late February, and that it won't contain revenue-generating proposals.

Michael Widmer, president of the business-backed Massachusetts Taxpayers Foundation, said Cahill's plan doesn't address the long-term need for new revenue.

"This wouldn't produce any additional money," said Widmer, who was a member of the transportation commission. "This would put these bridges at the top of the priority list and likely create longer delays for other bridges and highway renovation projects, because there's no new money."

Among the 10 Massachusetts bridges is the Fore River bridge, connecting Weymouth to Quincy. It was torn down 10 years ago and a temporary bridge put in its place. But the temporary bridge is good for only five more years, and the cost of a permanent replacement is $160 million.

"A permanent solution needs to be addressed," Cahill said.

It will cost at least $20 million to repair each bridge, Cahill said. The Interstate 95 bridge over the Merrimack River between Newburyport and Amesbury will cost $132 million to fix.

The other eight bridges, with their estimated repair costs:

-- Chelsea St. bridge, Chelsea, $120 million;

-- Route 113 bridge, Groveland, $75 million;

-- Route 9 bridge, Shrewsbury, $50 million;

-- Turner Falls bridge, Gill, $35 million;

-- Route 12 bridge, Leominster, $25 million;

-- Route 116 bridge, Chicopee, $24 million;

-- Beach Road bridge, Oak Bluffs, $30 million;

-- Interstate 95, Lexington, $21 million.

----------

"Mass. pension fund fires Goldman Sachs"

By Reuters, February 6, 2008

Goldman Sachs Group Inc. was fired as a stock-picker by the Massachusetts state pension fund yesterday after delivering lackluster returns and reorganizing some of its investment groups.

Trustees for the state's $53.7 billion pension fund voted to pull back the $1.2 billion that Goldman's Asset Management unit had invested in US stocks for the pension fund.

"We had an unimpressive visit with GSAM and recommend that they be terminated," Stan Mavromates, the pension fund's chief investment officer, told trustees at their regularly scheduled meeting, where they later voted.

The Massachusetts fund, which pays benefits to roughly 51,500 retirees and ranks as one of America's best performing public funds, will transfer the money to State Street Corp.'s State Street Global Advisors unit until fund officials select a replacement.

Pension fund staff did not like Goldman's plans to merge the team that specializes in quantitative research for traditional funds with a team that did similar work for hedge funds.

Goldman did not immediately return a call for comment.

At the same time, performance was lackluster, with Goldman returning only 2.86 percent for the pension fund's accounts, while the benchmark Standard & Poor's 500 index (excluding tobacco) gained 5.29 percent last year.

Pension fund staff traveled to New York in early January to meet with fund managers personally, Mavromates said. The meeting with Bob Jones and Mark Carhart, cochief investment officers for equities, did not go well. "We feel very uncomfortable with the changes GSAM is making and we didn't want to wait around for them," Mavromates said.

----------

"Towns face budget gaps"

By Ryan Hutton, North Adams Transcript

Thursday, February 7, 2008

ADAMS —Town Administrator William Ketcham warned the Selectmen Wednesday night that if Governor Deval Patrick's casino proposal does not pass, the town will be short $328,000 for the 2009 fiscal year.

"Patrick's budget proposal basically flat funded the towns," he told the board. "However, included in the governor's budget was gaming revenue and the legislature hasn't acted upon the casino legislation yet."

Ketcham said that if the town did not receive the $328,000 promised in Patrick's flat budget, at least that much would have to be cut. He said a number of the town's initiatives and improvement projects would have to be cut to make up the difference. However, he said not all was gloomy for the 2009 budget.

"We are in comparatively good shape next to other towns," Ketcham said. "Our tax rate has stayed low at $15.78 (per $1,000 valuation) per household. We are putting $750,000 of free cash into the budget to reduce the tax rate and the long delayed capital maintenance items are in and I'll be requesting appropriations of $98,000 from free cash to handle that."

The big variable in the coming budget season will be the amount of state aid based on the gaming revenues. Ketcham said that if the funding remains level, there will be about $1.6 million in the town's free cash account, $400,000 of which are fiscal 2007 taxes that weren't processed until 2008.

"There is actually more money out there than the books show," Ketcham said. "There are a lot of important projects going on in the town, the community development of Park Street and Summer Street and so on. It's a good time, if the budget stays level, to put some money into making the town better and more attractive to business."

Selectman Edward MacDonald said he was not pleased with the way the governor was handling the budget nor the position it put towns like Adams in.

"I don't understand how you can do a budget and not have money there, like having a phantom budget," he said. "You can't appropriate what you don't have and you can't figure in a gambling bill that doesn't exist. I don't think the bill has even been filed yet and a shortfall this big can give us major problems. You can't overcome revenue gaps like this. Really, we're caught in-between a budget with tighter numbers and one where the numbers don't exist."

Selectmen Chairman Joseph R. Dean Jr. pointed out that the reason Patrick handled the budget the way he did was all about political maneuvering.

"Well, the legislature hasn't passed it yet," he said. "This is going to put pressure on the legislature to pass it or force us to lose the money."

MacDonald pointed out that with the level funding, the town has cut its total budget by 25 percent over the last five years.

"We've cut everything we can from the budget and there's nothing left to cut," he said. "The governor is giving the legislator two choices, approve the legislation or raise taxes to make up for it."

In other business, the Selectmen announced that the state Department of Conservation and recreation will be acquiring 292 acres of land near McGrath Road, just east of East Road, as an expansion of the Savoy National Forest. They also announced that the Zoning Board of Appeals is looking for alternate members and the Board of Health needs nearly 300 volunteers to be part of the town's Medical Reserve Corps. The Corps is a volunteer position that would be called upon in the event of a town-wide emergency or mass inoculations. Selectman Joseph C. Solomon commended the merchants on Summer Street for forming a merchants association to give input on the renovation of Summer Street. The associations first meeting will be on Feb. 27 at 6 p.m. at The Grill on Spring Street.

----------

"Cahill says redesign would lower school cost: Treasurer, Newton mayor are at odds"

By Ralph Ranalli and Rachana Rathi, (Boston) Globe Staff, February 22, 2008

State Treasurer Timothy P. Cahill warned Mayor David B. Cohen of Newton yesterday that extensive design changes would have to be part of any meaningful plan to save money on the most expensive high school project in Massachusetts history.

The warning came in a bluntly worded letter in which Cahill accepted Cohen's request for help in holding down the soaring cost of building a new Newton North High School.

The project has come under increasing fire since Cohen announced last month that its estimated price tag had risen from $141 million to more than $186 million in six months and that the final cost likely could go even higher.

Last week, the mayor sent Cahill a letter inviting state officials to Newton to give their "suggestions on how we could save money on this important project."

In his response yesterday, Cahill raised questions about the timing of Cohen's request for help from the state School Building Authority, which is committed to paying $46.5 million of the project's cost.

The letter included a long list of documents Cahill is asking the city to provide before scheduling any future meeting.

While saying that he and the authority's executive director, Katherine Craven, would be happy to meet with Newton officials, Cahill pointed out that the agency has already been working for three years "to accommodate Newton's selected design for the high school project."

Over that time, the city has considered but rejected a number of cost-saving measures, including renovating the existing building and opting for a simpler design over the complex, zig-zag-shaped structure envisioned by renowned architect Graham Gund of Cambridge.

More recently, the city declined several other smaller cost-saving design changes, including scaling back the school's multilevel theater into a single-level auditorium and using polished concrete blocks instead of brick for the exterior.

While Cohen said recently that he was willing to revisit some of those smaller decisions, Cahill wrote that the time for minor adjustments to the project had already come and gone.

"Given the timing of your correspondence and the fact that the pouring of the foundation for the newly designed school is imminent," Cahill wrote, "I would caution that the opportunities for significant cost savings may no longer be available unless you and the city agree to make changes to the proposed design of the school, which may be extensive."

That sentiment appears to put the two sides significantly at odds. Cohen has said repeatedly lately that any savings from major design changes would be offset by the cost associated with delays in building the project.

The mayor has also rejected any suggestion that construction of the new school be delayed, even temporarily, and crews began pouring concrete this week.

City spokesman Jeremy Solomon said yesterday afternoon that the city would provide the extensive project documentation requested by the treasurer in his letter, but he called Cahill's suggestion of major design changes "a big question mark."

"I am sure the treasurer knows the ramifications of changing the design at this stage in the process," Solomon said.

Opponents of the current plan said they were encouraged by Cahill's offer to help.

"I only wish his invitation would have been accepted sooner," said Alderman Ken Parker, who has backed scrapping the Gund design and has formed a committee to explore a possible run for the mayor's office.

"But I'm optimistic that we can get this project back on track. We need a high school project we can afford, not one that will force us to lay off police and firefighters."

----------

"A cautionary school funding tale"

The Berkshire Eagle - Editorial

Monday, February 25, 2008

Pittsfield Mayor James Ruberto has put the possibility of a new high school on the agenda for the current term, and with both schools aging and the city's population having declined from the days when two schools, Pittsfield High and Taconic, were absolute necessities, the discussion is worthwhile. There is certainly much to be said for putting all of the programs and services that the city's high school students require under one roof. Happily, Pittsfield has the community of Newton to serve as an example of how not to approach this issue.

In contrast to Pittsfield, Newton is a wealthy community, but with its $141 million Newton North High School now projected to cost $186 million and likely to go higher, residents are concerned and state Treasurer Tim Cahill, custodian of the state School Building Authority, has weighed in on the need to cut expenses. The Authority, which has spent the past couple of years digging out from under past construction debts, is committed to paying $46 million of the project's cost.

The state's prodding aside, city officials declined to consider making design changes to save money, among them proposals to reduce a multilevel theater to one level and replace aesthetically pleasing brick for the exterior with concrete blocks. With the foundation for the new school to be laid imminently, the city is apparently poised to go ahead with much of the financing for the school uncertain, which should worry taxpayers.

We assume the state will not reward Newton for its extravagance and refusal to compromise by writing it a check for even more money out of the School Building Authority fund. It will become necessary to once again shut down access to the fund if schools are allowed to deplete it through excessively costly projects. Concerned Newton alderman Ken Parker told The Boston Globe Friday that the community needs a new school, but "not one that will force us to lay off police and firefighters." No community in the state should ever get itself into such a bind when building a new school that an extreme remedy along those lines would even be considered.

----------

A Boston Globe Editorial: Short Fuse, February 25, 2008

"Newton North: Redesign is a dead end"

The City of Newton should offer a polite "no thanks" to state Treasurer Timothy Cahill's offer to help reduce costs on the Newton North High School project. At more than $180 million, the new building will be unnervingly expensive. But as Cahill pointed out in a letter, cost savings can probably be achieved only by significant changes in the design. These will reduce educational and extracurricular programs offered at the school. And a redesign would delay construction for years and produce additional costs. If the city wants to go this route, it can make the cuts itself. If it wants a high school with the same range of activities as the existing Newton North, it should be prepared, with limited state aid, to foot the bill.

----------

"House, Senate leaders agreed to 4.4 percent local aid hike"

The Boston Globe Online, March 10, 2008

BOSTON—Legislative leaders have agreed to a 4.4 percent increase in aid to cities and towns.

more stories like thisSenate President Therese Murray and House Speaker Salvatore DiMasi say the $223 million increase will bring the total amount of state aid to local communities to $5.26 billion for the fiscal year starting July 1.

The agreement comes nearly four months before the start of the new fiscal year.

It's intended to help cities and towns craft their own budget.

The increase also comes despite lagging lottery revenues.

Cities and towns had been promised $935 million in lottery aid, but the lottery is projecting only $811 million in revenues. The state will make up the difference under the plan.

----------

"State's fiscal picture dims: Cuts, tax hikes may be on table"

By Matt Viser, (Boston) Globe Staff, March 26, 2008

As the sputtering economy sends shocks from Wall Street to Main Street, the reverberations are being felt on Beacon Hill, where key officials acknowledged yesterday that the signs are bad and the future may be even worse.

Income tax revenues are expected to shrink as the recession takes hold, worsening an anticipated $1.3 billion budget deficit. Municipal officials, heavily dependent on state aid, say their budget problems have already risen to crisis proportions.

State health program faces crucial fiscal choices. A12.

State Treasurer Timothy P. Cahill said yesterday that, yet again, he must borrow hundreds of millions in short-term notes to pay the state's bills - like a consumer using a credit card to make a mortgage payment.

All of this is set against the fact that the state already has the high est per capita government debt in the country - and now will be forced to borrow even more to keep a deteriorating transit system and its aging college campuses from completely crumbling.

"Every taxpayer and tollpayer in Massachusetts is overburdened at the same time as our infrastructure is about to implode," said Senator Mark C. Montigny, Senate chairman of the Joint Committee on Bonding, Capital Expenditures and State Assets and a New Bedford Democrat. "We are headed for a much more dangerous time than people realize. We've got all these nasty variables converging at the same time."

Governor Deval Patrick is readying a major economic speech in which he will discuss the effect on the budget, although it has not yet been scheduled, his aides said. House budget writers are beginning to craft a detailed budget for fiscal year 2009, and they will have to choose between raising taxes and fees and cutting programs.

"This has been the most difficult budget I've had to deal with," said Representative Robert A. DeLeo, a Winthrop Democrat who is in his fourth year as chairman of the House Committee on Ways and Means. "It's been further exacerbated by looking into the future."

Patrick submitted a $28.2 billion budget proposal in January that avoided large-scale cuts and included several spending initiatives and money-generating proposals - including $124 million from his ill-fated proposal to license three casinos, a plan that the House killed last week.

Moving forward, while few are talking about serious program cuts, a big increase in the cigarette tax, tightening corporate tax loopholes, and digging into the state's rainy day fund are apparently the most viable means of balancing the next budget.

Officials also are looking at gas tax increases, higher and more widespread highway tolls, and the less tangible possibility that an array of economic stimulus plans, including the promise of a $1 billion shot in the arm for the state's biotech industry, will pay off with new jobs and investment.

As House and Senate leaders start focusing on the details, they are working under an even bleaker scenario than when Patrick drew up his plan. Following a stream of negative news caused by the nation's crisis in debt markets, a report last week released by MassINC said the state is at a financial "point of reckoning."

"We're just teetering on the precipice," said Michael Widmer, president of the Massachusetts Taxpayers Foundation, a nonprofit budget study group that is funded by businesses. "I haven't heard any real ideas."

Cahill said he will be forced to borrow $400 million by Monday to fulfill the state's obligations, including local aid and pension payments. The state has occasionally had to borrow before to meet short-term cash shortages - including $600 million in 2006 and $1 billion in 2007 - but never this late in a fiscal year.

"This to me is a wake-up call," Cahill said. "I'm hopeful that it's going to be a message to everyone in the [State House] that we've got to get spending under control. It's not just enough to look for new revenue sources."

The state will be able to repay the loan by the end of April - once income tax receipts start to come in - but the shortfall will cost about $3 million in interest payments, Cahill said. That is the equivalent to the full annual tax bill of about 2,200 taxpayers.

Leslie Kirwan, secretary of administration and finance, did not offer a complete explanation of why the state is coming up short of cash. "I would be very cautious about saying it's a spending problem. We do not believe there is a significant issue on overspending," she said.

Budget cuts are definitely on the table in the Senate and the House.

"It's more than tight," said Senator Steven C. Panagiotakos, chairman of the Ways and Means Committee. "The bottom line is spending is going far ahead of revenue growth. Every area is an area to cut."